Explore our collection of featured HCPLAN Articles, Press Releases, and External News.

Ali Khan, MD, MPP, FACP is a practicing general internist and the Chief Medical Officer, Medicare at Aetna/CVS Health, where he advances strategies, policies and programs that drive the delivery of clinical excellence, clinical impact and superb member experience for Aetna’s over 11 million Medicare members nationally.

He joins Aetna from his prior role as Chief Medical Officer, Value Based Care Strategy at Oak Street Health, where he led efforts in managed care strategy, medical management, clinical design, workforce development and public policy. Ali joined Oak Street Health in 2019 as Executive Medical Director of the eight-state, 60+-center Heartland Division and continues to practice general internal medicine at Oak Street’s clinics on Chicago’s West Side.

Prior to Oak Street, he served as CareMore Health’s Clinical Design Officer and in leadership roles at Iora Health.

Ali serves on the faculty of the Yale School of Medicine and Northwestern’s Kellogg School of Management, on the Harvard Kennedy School Healthcare Policy Leadership Council and as a Director on the American Board of Internal Medicine’s Internal Medicine Specialty Board, the American Board of Internal Medicine Foundation, the Better Medicare Alliance and AcademyHealth. Ali was recognized as one of Modern Healthcare’s Top 25 Emerging Leaders in 2021, Crain’s Chicago Business’ 40 Under 40 in 2022, Crain’s Chicago Business’ Notable Executives of Color in Health Care in 2022 and the American College of Physicians’ Walter J. McDonald Award winner (as the nation’s top early career internal medicine physician) in 2024. He is a fellow of the California Health Care Foundation and Leadership Greater Chicago.

Ali completed his residency at Yale-New Haven Hospital. He is a graduate of the Harvard Kennedy School and VCU’s Medical College of Virginia, earning joint M.D. and M.P.P. degrees as a Harvard Public Service Fellow, and VCU’s B.S./M.D. Guaranteed Admissions Program in Medicine.

Abe Sutton serves as the Director of the Center for Medicare and Medicaid Innovation and Deputy Administrator for the Centers for Medicare and Medicaid Services (CMS). Before assuming this role in January of 2025, he was a Principal at Rubicon Founders where he co-founded two health service companies; Honest Health, which focuses on enabling primary care physicians, and Evergreen Nephrology, which focuses on enabling nephrologists. Sutton focused on health policy with the federal government from 2017 to 2019, serving at the National Economic Council, Domestic Policy Council and Department of Health and Human Services. In these roles, he coordinated health policy across the federal government, with a focus on the shift to paying-for-value within Medicare, increasing choice and competition in health care markets, and updating the federal government’s approach to kidney care.

Sutton started his career as a consultant with McKinsey & Company, where he worked with clients in the health sector. He holds a law degree from Harvard Law School and undergraduate degrees in political science, management, and health care management and policy from the Wharton School and the College at the University of Pennsylvania. In 2018, he was named to Forbes 30 Under 30 for Law and Policy.

Stephanie Carlton, CMS Chief of Staff and Deputy Administrator, is a healthcare leader with unique experience across the dimensions of the U.S. health care economy – business, policy, higher education, and clinical. When a Partner at McKinsey & Company, Stephanie was a leader in McKinsey’s SHaPE Practice with a deep focus on innovation and strategy. She also co-founded a place-based transformation with 20 community leaders in Texas to improve holistic health outcomes. Prior to McKinsey, she led Medicare Advantage and Medicaid issues on the US Senate Finance Committee (Republican staff) and worked as a labor & delivery nurse at Georgetown University Hospital. Stephanie has guest lectured at the University of Pennsylvania Wharton School, served as a fall 2022 resident fellow at the Harvard Kennedy School Institute of Politics, and was on the business school faculty at the University of Texas at Austin. She has served on the boards of the Health Care Cost Institute, Ignite Health Foundation, and the University of Texas McCombs Alumni Association.

Dr. Oz serves as the 17th Administrator for the Centers for Medicare & Medicaid Services under HHS Secretary Robert Kennedy, Jr., and President Donald Trump. He is a Professor Emeritus at NY Presbyterian-Columbia Medical Center and has won nine Daytime Emmy® Awards.

Dr. Oz received his undergraduate degree from Harvard University and obtained a joint MD and MBA from the University of Pennsylvania School of Medicine and Wharton Business School.

He is the author of eight New York Times Best Sellers and was a founder of a lifestyle magazine with a focus that extends well beyond health and wellness to relationships, beauty, food and home.

In 2003, Dr. Oz founded a national non-profit which emulates the Peace Corps by putting energetic recent college graduates into high schools around the country to teach diet, fitness and mental resilience. He has raised $100 million to help 3 million teens with this nationwide program.

In addition to belonging to every major professional society for heart surgeons, Dr. Oz has been named Time magazine’s 100 Most Influential People, Forbes’ most influential celebrity, Esquire magazine’s 75 Most Influential People of the 21st Century, Harvard’s 100 Most Influential Alumni, AARP 50 Influential People Over 50, and received the Ellis Island Medal of Honor and a Hollywood Walk of Fame Star.

Kristie Spencer is Vice President of Provider Partnerships at Elevance Health. She leads enterprise-wide strategy to optimize the company’s value-based contracting portfolio and deepen partnerships with care providers across Medicare, Medicaid, Commercial lines of business, and Carelon. Kristie is responsible for driving a multi-year transformation to simplify and scale value-based care, strengthen provider enablement, and improve Stars and HEDIS performance through aligned incentives and actionable insights. She draws on more than two decades of leadership across payers and providers to operationalize strategy, elevate provider success, and drive measurable results in quality, cost, and experience.

Adam Boehler, Managing Partner at Rubicon Founders, has nearly 20 years of experience in entrepreneurship and innovation in the private sector and in the U.S. Government. As the child of a primary care physician and a speech pathologist, Adam’s parents instilled in him the importance of caring, family, and community, and he saw how magic the time is between providers and their patients and the change that this can make in someone’s life.

Adam founded three healthcare companies including Landmark Health, a company delivering around-the-clock medical care to chronically ill patients. From there, Adam took on major roles in the U.S. Government, including Director of the Center for Medicare and Medicaid Innovation (CMMI), where he worked on value-based care for the United States. Adam was also a founding member of Operation Warp Speed, unanimously confirmed by the Senate as the first CEO of the International Development Finance Corporation (DFC), and a negotiator in the historic Abraham Accords.

After his government tenure, Adam started Rubicon because he wanted to build healthcare companies to transform how care is delivered in America, as he saw the power of bringing the private and public sector together to solve our nation’s greatest healthcare challenges.

Danielle A. Lloyd is the SVP, private market innovations & quality initiatives for AHIP. She is responsible for policy development and trend analysis in the areas of provider payment models, quality measurement, accreditation, data interoperability, and emerging technologies. She serves as chair of the steering committee for the national Core Quality Measure Collaborative. With 25 years’ experience in healthcare policy, Danielle has also worked on an array of healthcare issues for hospital associations and governmental agencies. She has a BA from the U. of Pennsylvania and an MPH from the U. of California, Berkeley, and a certificate in Technology & Innovation Advancement from the Massachusetts Institute of Technology xPRO program.

Dr. Conway was named CEO of Optum in 2025. Optum has 300K employee team members who serve over 127 million people with annual revenue exceeding $250 billion. It includes three main business units. Optum Health, with nearly 90,000 doctors and other clinicians, delivers clinical care and services in clinics, homes, ambulatory surgical centers, behavioral health, and other settings across the country and serves payers, large employers and the government. Optum Rx serves over 62 million people providing pharmacy care services and over 1.6 billion prescriptions per year. Optum Insight is a data and technology business that serves payers, health systems, life sciences, and others across the country. Collectively, Optum delivers health care services to help make the health system better for everyone.

Previously, Patrick served as chief executive officer of Optum Rx. In this role, he led an integrated pharmacy care services organization that is making drugs more affordable and creating a better experience for consumers, filling more than 1.6 billion retail, mail and specialty drug prescriptions annually. He joined Optum in February 2020 and previously served as the chief executive officer of Care Solutions, where he led a portfolio of care continuum businesses serving over 70 million people across acute and post-acute care, care in the home in-person and virtually, mental and behavioral care benefits and delivery, broad population and complex disease health management, specialty care and government health services.

Dr. Conway was president and chief executive officer of Blue Cross and Blue Shield of North Carolina from 2017-19. From 2011 to 2017, he served as Deputy Administrator for Innovation and Quality at the Centers for Medicare and Medicaid Services and as director of the Center for Medicare and Medicaid Innovation and the agency’s Chief Medical Officer. Before joining CMS, he oversaw clinical operations and quality improvement at Cincinnati Children’s Hospital Medical Center.

Dr. Conway is a practicing pediatric hospitalist. He was elected to the National Academy of Medicine in 2014, received the President’s Senior Executive Distinguished Service Award, and was a White House Fellow from 2007 to 2008. He earned his MD with high honors from Baylor College of Medicine, residency training at Boston Children’s Hospital, and Master of Science in clinical epidemiology from the University of Pennsylvania.

With an extensive background in health care leadership and policy, Andy brings a wealth of experience advancing innovation and value-based care to improve Americans’ health. Andy holds key leadership positions in the private and non-profit sectors, including as a commissioner on the National Academy of Medicine’s Commission on Investment Imperatives for a Healthy Nation. He is a founder and Board Chair Emeritus of United States of Care, a national non-profit health advocacy organization, as well as a founding partner of Town Hall Ventures, a healthcare firm that invests in underrepresented communities. He has also co-chaired a national initiative on the future of health care at the Bipartisan Policy Center.

Andy’s experience includes serving as President Obama’s head of Medicare and Medicaid, were he led many of the nation’s most important health care initiatives and oversaw the turnaround and implementation of the Affordable Care Act. He was also a member of President Biden’s President’s Council of Advisors on Science and Technology (PCAST) working group on public health and the White House Senior Advisor for the COVID-19 response.

From a young age, Libby Hoy became a family caregiver to her mother while she battled breast cancer. Shortly after her death, Ms. Hoy became a parent to three sons who live with mitochondrial dysfunction, and in 2016 Ms. Hoy was diagnosed with stage IV salivary gland cancer. These experiences over the course of decades have shaped her passion for creating a person-centered health system. She strives to build the infrastructure and capacity for health care organizations to engage every patient and family member.

In 2010, Ms. Hoy founded PFCCpartners to create a community of patients, families, and health care stakeholders committed to the shared learning of Patient & Family Centered Care practice. PFCCpartners also supports the PFANetwork, inclusive of more than 1000 patient family advisors in active partnership with health systems, measure developers, policy, quality improvement teams, and researchers across the country to improve the quality, safety, experience, and design of health care.

PFCCpartners serves multiple CMS contractors to implement effective patient family engagement strategies across CMS quality improvement programs.

Tori Bratcher serves as president of Trinity Integrated Care, LLC, and system director of alternative payment models for Trinity Health. In this role, Ms. Bratcher has accountability for Trinity Health’s national alternative payment models, including serving as the president for one of the nation’s largest Medicare Shared Savings Program (MSSP) ACOs. She also has system accountability for several of Trinity Health’s clinically integrated networks. She is a member of the system team accountable for $11 billion of medical expense for two million lives in Medicare ACOs, Medicare Advantage, Medicaid, and commercial alternative payment models. Trinity Health has been a top performer on quality and affordability in its MSSP and Next Generation ACOs.

Ms. Bratcher joined Trinity Health from Indiana University (IU) Health, the largest academic health system in the state of Indiana, where she last served as executive director of population health services. In this role, she managed a portfolio of risk contracts while building and operating the capabilities required to achieve strong financial and clinical outcomes within population health for over seven years. Prior to her role at IU Health, Ms. Bratcher spent time in other operational and strategic positions within clinically integrated networks and physician group practices throughout the Midwest.

Ms. Bratcher received her Bachelor of Science from Indiana Wesleyan University and Master of Health Administration from University of Illinois Chicago. She lives with her husband and two daughters in Indianapolis, where they enjoy being outdoors and playing soccer.

Ellie Hallen serves as Allina Health’s director of care transformation, population health, and the Allina Integrated Medical Network. Across the health system and clinically integrated network, she builds the strategy and capabilities required to optimize patient outcomes and overall value-based care performance. Ms. Hallen drives exceptional population health and well-being outcomes, overseeing operations, strategy, performance, data analysis and insights, budgeting, and project implementation to scale transformative, human-centered, and value-based care models. Ms. Hallen has led in operations and strategic health care roles in settings ranging from a rural community hospital to a regional safety-net hospital to large integrated health care delivery systems. She is a convener, mentor, and influencer dedicated to fostering a culture of trust, engagement, and continuous improvement across the market, organization, patient populations, strategic partnerships, and the larger community.

Ms. Hallen achieved her Master of Healthcare Administration from the University of Minnesota in 2015 and an undergraduate degree from Boston College in economics and psychology in 2012. She was recognized in 2023 as a TRUST Women in Healthcare Leadership annual awardee for health and well-being leadership, and by Becker’s Healthcare as a “40 Under 40” emerging health care leader.

Collaboratives and Innovative Partnerships

Washington Multi-Payer Collaborative

Initiative Description: The Washington State Health Care Authority formed a Multi-Payer Collaborative (MPC) to increase access to high-quality comprehensive primary care to improve health care outcomes. The MPC aims to improve primary care by enhancing the patient experience, improving population health outcomes, reducing costs, and improving the work life of health care providers. Part of the work being done by the MPC is the introduction of the MPC Learning Cohort, which will be an avenue for providers to shape where payers align their efforts to create primary care provider supports.

Strategic and Tactical Uses: Practices that are good candidates and meet certain characteristics can join an MPC Learning Cohort and help guide health plan alignment. Those that are not involved in the Washington MPC can use the strategies and direction of the MPC to help shape their own guiding principles. Practices in Washington that are participating in the Centers for Medicare & Medicaid Services’ new Making Care Primary model can benefit from the lessons of MPC’s current Learning Cohort to enable greater success in the new model.

Multi-payer Alignment Foundational Element: Providing and Leveraging Technical Assistance

Timeframe: Active

For additional information, please visit https://www.hca.wa.gov/about-hca/programs-and-initiatives/value-based-purchasing/primary-care-transformation

Stakeholders can reach out to the Multi-payer Collaborative directly with questions wampc-cebpstaff@ohsu.edu

Who Might Use This: ![]() Health Plans

Health Plans

Collaboratives and Innovative Partnerships

Vermont’s All-Payer Accountable Care Organization Model

Initiative Description: The Vermont All-Payer Accountable Care Organization (ACO) Model (VTAPM) began on January 1, 2017 and is scheduled to end on December 31, 2024. It is a culmination of Vermont’s commitment to health care transformation, building from Vermont’s Global Commitment to Health Section 1115 waiver, the Blueprint for Health, and a multi-payer ACO Shared Savings Program (SSP) pilot under Vermont’s State Innovation Models (SIM) Testing Grant. Medicare, Medicaid, BlueCross BlueShield of Vermont (BCBSVT), MVP Health Care, and the State Employees’ Health Care Plan — a self-insured plan administered by BCBSVT — participate in the model, representing the majority of covered lives in the state. The Model is administered by OneCare Vermont, which coordinates all funding from all VTAPM payment mechanisms — all-inclusive population-based payment, fixed prospective payment, and traditional fee-for-service (FFS). The Model aims to use this ACO structure to reduce statewide spending and improve population health outcomes.

Strategic and Tactical Uses: The VTAPM has been linked to reductions in Medicare spending, decreases in acute hospital and specialty visits, and efforts to improve care coordination and strengthen primary care. Despite these successes, the Model had mixed success related to payment reform, with FFS as the primary funding mechanism by participating commercial plans, and mixed quality measure alignment, with only 7 of the 18 OneCare measures in common among participating health plans. Other states can look to the VTAPM model to understand how decades of work toward health care payment reform efforts can be used to develop a statewide model with successful cost and quality outcomes. Lessons learned from the evaluation report — including the need to align financial incentives and attribution, and the importance of goal setting for aligned payment mechanisms (see additional information below) — should also be reviewed for states looking to leverage findings from Vermont.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components

Timeframe: Active

For additional information, please visit

https://www.cms.gov/priorities/innovation/

data-and-reports/2023/vtapm-3rd-eval-full-report

Who Might Use This: ![]() Health Plans

Health Plans

Government Regulation and Guidance

Updated Centers for Medicare & Medicaid Services Health Equity Framework

Initiative Description: The Centers for Medicare & Medicaid Services (CMS) has updated the agency’s Framework for Health Equity, expanding upon its initial 2022-2032 priorities. The five priorities for reducing disparities in health include: expanding the collection, reporting, and analysis of standardized data; assessing causes of disparities within CMS programs, and addressing inequities in policies and operations to close gaps; building capacity of health care organizations and the workforce to reduce disparities in health and health care; advancing language access, health literacy, and the provision of culturally tailored services; and increasing all forms of accessibility to health care services and coverage.

Strategic and Tactical Uses: The Framework offers insight on alignment priorities for health equity data collection, sharing, and use to reduce observed health disparities.

Multi-payer Alignment Foundational Element: Whole Person Care

Timeframe: Active

For additional information, please visit https://www.cms.gov/About-CMS/Agency-Information/OMH/health-equity-programs/cms-framework-for-health-equity

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Community-Based Organizations

Community-Based Organizations

Government Regulation and Guidance

Trusted Exchange Framework Common Agreement Standards

Initiative Description: The Trusted Exchange Framework Common Agreement (TEFCA) was published by the Office of the National Coordinator for Health Information Technology (ONC) to establish the infrastructure model and governing approach for users in different networks to securely share basic clinical information with each other, all under commonly agreed-to expectations and rules. TEFCA describes a common set of non-binding, foundational principles for trust policies and practices that can help facilitate an exchange among organizations. These principles include standardization, transparency, cooperation and non-discrimination, privacy, security, patient safety, access, and data-driven accountability.

Strategic and Tactical Uses: Currently, providers may have disparate access to patient data across multiple networks, adding to their administrative burden. Patients may also struggle to access their own data easily. As TEFCA becomes operational, organizations and patients will benefit from improved access to data as TEFCA aims to create seamless nationwide exchange.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit

https://www.healthit.gov/topic/

interoperability/policy/trusted-

exchange-framework-and-common-

agreement-tefca

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Policy Makers

Policy Makers

Government Regulation and Guidance

The Universal Foundation Measure Set

Initiative Description: In an effort to align measures that drive quality improvement and care transformation, the Centers for Medicare & Medicaid Services (CMS) selected adult and pediatric measures that promote the best, safest, and most equitable care for individuals across critical quality areas: wellness and prevention, chronic conditions, behavioral health, person-centered care, and seamless care coordination. The measures will be used across CMS quality programs and prioritized for stratification and digitization.

Strategic and Tactical Uses: Organizations can compare the Universal Foundation with other aligned measure sets to identify overlap and prioritize measures for multi-payer implementation initiatives. The Universal Foundation will continue to evolve over time with population-specific “add-on” measure sets.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://www.cms.gov/aligning-quality-measures-across-cms-universal-foundation

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Purchasers |

Purchasers | ![]() Policy Makers

Policy Makers

Alignment Resources and Helpful Documents

The Future of Sustainable Value-Based Payment:

Voluntary Best Practices to Advance Data Sharing

Initiative Description: The National Association of Accountable Care Organizations (NAACOs), American Medical Association (AMA), and AHIP created a playbook that presents voluntary guidelines and best practices to advance data sharing, which includes data privacy, data infrastructure, value-based care participant readiness, federal health information technology requirements, and financial investment. The playbook is based on findings from an advisory workgroup comprising members from each partner association, a managing committee of association leaders, a literature review, an environmental scan, and interviews with subject matter experts.

Strategic and Tactical Uses: Organizations can use the playbook to develop or refine their own value-based care strategy, especially with regard to data and infrastructure practices.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.aurrerahealth.com/wp-content/uploads/2023/07/Voluntary-Best-Practices-to-Advance-Data-Sharing.pdf

Who Might Use This:![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Community-Based Organizations

Community-Based Organizations

Collaboratives and Innovative Partnerships

North Carolina Healthy Opportunities Pilots

Initiative Description: The North Carolina Health Opportunities Pilots (HOP), part of NC’s Section 1115 waiver, is a comprehensive program dedicated to solving non-medical needs for Medicaid enrollees. HOP covers the cost of 29 interventions defined and priced in the Department of Health and Human Services’ Pilot Fee Schedule, including housing navigation and move-in fees, food and nutrition access care, transportation reimbursement, and violence intervention services. The North Carolina Department of Health and Human Services intends to expand HOP services to new populations beginning with those eligible for Tailored Care Management.

Strategic and Tactical Uses: HOP is the country’s first comprehensive program to reimburse for such a broad set of services and, unlike traditional Medicaid services, supports the enrollee and their family (e.g., an enrollee who is food insecure will receive a food box covering the entire family). Other states can use North Carolina’s HOP program to evaluate the benefits of non-medical interventions. Based on the reports from the Department of Health and Human Services, similar programs can be implemented across other states, helping to reduce health care costs and improve population health.

Multi-payer Alignment Foundational Element: Whole Person Care

Timeframe: Active

For additional information, please visit https://www.ncdhhs.gov/about/department-initiatives/healthy-opportunities/healthy-opportunities-pilots and https://ncmedicaljournal.com/article/94844-reflecting-on-nearly-two-years-of-north-carolina-s-healthy-opportunities-pilots

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Community-based Organizations

Community-based Organizations

Collaboratives and Innovative Partnerships

NCCARE360

Initiative Description: NCCARE360 is a statewide network that unites health care and human services organizations with a shared technology. The NCCARE360 implementation team includes United Way of North Carolina/NC 211, Unite Us, and Expound Decision Systems. These organizations link people and families to free and local health and human services resources, offer a platform for secure and timely care coordination and outcomes, and create a data repository model to manage social determinants of health resources in North Carolina.

Strategic and Tactical Uses: North Carolina community-based organizations, health plans, and health systems can join the NCCARE360 network and gain access to the resources that they provide. Outside of North Carolina, organizations can look to form a public-private partnership like NCCARE360 and create a similar cross-sectoral referral technology platform or expand their current platforms to a statewide scale.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing, Whole Person Care

Timeframe: Active

For additional information, please visit https://nccare360.org/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Community-Based Organizations

Community-Based Organizations

Collaboratives and Innovative Partnerships

National Quality Forum Aligned Innovation

Initiative Description: Aligned Innovation is a multi-stakeholder initiative from the National Quality Forum (NQF) that advances quality measures for behavioral health and maternal health outcomes. The recent new measures prioritized by the Coalition include outcomes for mild to moderate behavioral health conditions and the reduction of severe maternal morbidity. The program is differentiated by a rapid-cycle measure development process, rather than the multi-year timeframe that’s typical of traditional measure development.

Strategic and Tactical Uses: These measures are outcome-oriented and patient-centered and can be used to support prospective measure alignment across the industry. Health plans not participating in Aligned Innovation can look to the initiative for lessons on measure development and achieving shared implementation.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit

https://www.qualityforum.org/News_And_

Resources/Press_Releases/2023/NQF_s_

Aligned_Innovation_Initiative_to_

Advance_Next_Generation_Measures_of_

Outcomes_for_Behavioral_Health_and_

Maternity_Care.aspx

Who Might Use This: ![]() Health Plans

Health Plans

Collaboratives and Innovative Partnerships

National Committee for Quality Assurance Bulk FHIR Coalition

Initiative Description: The Bulk FHIR Quality Coalition is a National Committee for Quality Assurance (NCQA) and public-private sector collaboration focused on leveraging regulated Fast Healthcare Interoperability Resources (FHIR) data for NCQA’s Healthcare Effectiveness Data and Information Set (HEDIS) measures. Phase 1 of the Coalition involves health plans, providers, and accountable care organization cohorts that create pipelines from clinical data and claims data, which are tested and validated against specific HEDIS FHIR Implementation Guides from NCQA.

Strategic and Tactical Uses: By participating in NCQA’s Bulk FHIR Coalition, organizations can be at the forefront of health care technology and data management, as well as support the broader goals of enhancing health care quality, efficiency, and patient outcomes. Organizations not yet ready to participate can follow the results of the Coalition for future implementation.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.ncqa.org/bulk-fhir-api-quality-coalition/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Policy Makers

Policy Makers

Collaboratives and Innovative Partnerships

Minnesota Community Measurement

Initiative Description: Minnesota Community Measurement (MCM) is using data to improve health care in the region. They work with doctors, hospitals, clinics, insurance companies, purchasers, and state agencies to design measures, and then collect, analyze, and share actionable data on health care quality and cost. MCM releases a variety of annual public reports, including cost and utilization, health care quality, disparities by plan and demographics, and spotlight reports. These reports help consumers compare and choose clinics based on quality and cost ratings, understand the care they should receive, and learn how to save money on their care.

Strategic and Tactical Uses: MCM hosts public meetings and forums in order to gather community feedback on upcoming measures, guiding principles, specifications, and priorities. Entities in Minnesota are also encouraged to become members of MCM and help further their mission of using data to improve the health care industry.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting, Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://mncm.org/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Purchasers

Purchasers

Collaboratives and Innovative Partnerships

Massachusetts Quality Measure Alignment Taskforce

Initiative Description: Massachusetts began convening the Taskforce in 2017 in order to: (1) build consensus on an aligned measure set for voluntary adoption by health plans in global budget-based risk contracts, (2) identify strategic priority areas for measure development, and (3) advise on the measurement and reporting of health inequities. Since 2017, the Taskforce has released annually updated measure sets for shared implementation. The Taskforce also maintains “Developmental Set measure topics,” which lists topics and measures that may be implemented in the future.

Strategic and Tactical Uses: The state releases a yearly Massachusetts Aligned Measure Set for health plan uptake and alignment. The Taskforce publicly tracks uptake of the measure set and reports findings. Adherence to the Aligned Measure Set among insurers that report to the Task Force has steadily increased from 65% in 2019 to 93% in 2023. Other states can look to the Taskforce to pursue and track measure alignment or expand the work to create a cross-state approach to quality measure alignment.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://www.mass.gov/info-details/eohhs-quality-measure-alignment-taskforce

Who Might Use This: ![]() Health Plans

Health Plans

Collaboratives and Innovative Partnerships

Kentuckiana Health Collaborative

Initiative Description: The Kentuckiana Health Collaborative (KHC) is a coalition of businesses and health care stakeholders focused on improving health care quality, making health care more affordable, and promoting equitable health care. KHC leads efforts for consolidated measurement and reporting by working with health plans to collect claims data that informs a quality measure list and reporting.

Strategic and Tactical Uses: KHC releases the Kentucky Core Healthcare Measures Set (KCHMS) bi-yearly. The measure set includes 42 primary care quality measures that serve as the foundation for KHC’s consolidated reporting. The set aims to reduce provider reporting complexity and align Kentucky’s health care organizations around a common set of quality measures. Other states can look to KHC for how to publicly report on quality measures.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://khcollaborative.org

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers

Purchasers

Alignment Resources and Helpful Documents

Integrated Healthcare Association’s Align. Measure. Perform. Program

Initiative Description: The Integrated Healthcare Association’s (IHA) Align. Measure. Perform. (AMP) program is an initiative designed to improve health care quality and reduce costs through a coordinated approach in California. The program seeks to align incentives, measure performance, and reward high-quality, cost-effective care. AMP has four program components: an aligned measure set and benchmarking, incentive design, public reporting, and public recognition. Today, 16 health plans and more than 200 physician organizations participate in AMP.

Strategic and Tactical Uses: Plans, providers, and patients in California can participate in AMP programs by implementing measures, identifying improvement opportunities, and reviewing publicly reported results to make decisions about their health care providers. Other states or convening organizations can look to the AMP program for guidance on collective action toward value-based payment and quality measure improvement.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Timely and Consistent Data Sharing, Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://iha.org/performance-measurement/amp-program/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers

Providers

Government Regulation and Guidance

Final Rule to Expand Access to Health Information and Improve the Prior Authorization Process

Initiative Description: The final rule requires Medicare Advantage (MA) organizations, Medicaid and the Children’s Health Insurance Program (CHIP) fee-for-service (FFS) programs, Medicaid managed care plans, CHIP managed care entities, and issuers of Qualified Health Plans (QHPs) offered on the Federally-Facilitated Exchanges (FFEs) to improve the electronic exchange of health information and prior authorization processes for medical items and services. It also requires the same entities to implement a Health Level 7 (HL7) Fast Healthcare Interoperability Resources (FHIR) prior authorization application programming interface (API), which can be used to facilitate a more efficient electronic prior authorization process between providers and health plans by automating the end-to-end prior authorization process. Compliance requirements will begin in January 2027.

Strategic and Tactical Uses: Medicare FFS has already implemented an electronic prior authorization API, demonstrating the efficiencies other health plans could realize by implementing such an API. By implementing the requirements, the prior authorization process will reduce administrative burden on the healthcare workforce, empower clinicians to spend more time with patients, and prevent avoidable delays in care for patients. Health plans can prepare for compliance ahead of the start date January 1, 2027.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Upcoming

For additional information, please visit https://www.cms.gov/newsroom/press-releases/cms-finalizes-rule-expand-access-health-information-and-improve-prior-authorization-process

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Enabling Organizations

Enabling Organizations

Collaboratives and Innovative Partnerships

Delaware Primary Care Reform Collaborative

Initiative Description: The Delaware Health Care Commission created the Delaware Primary Care Reform Collaborative as part of a statewide effort to expand value-based care delivery models. The Collaborative develops recommendations to strengthen the primary care system in Delaware and includes health plans, providers, and Delaware state health leaders. The Collaborative also creates annual reports that provide insight into the primary care workforce and other relevant trends.

Strategic and Tactical Uses: The Delaware Primary Care Reform Collaborative hosts open meetings and posts the schedule, along with meeting minutes and materials, to their website for the public to review. The Collaborative also publishes trends and guidelines that result from their meetings. Other state agencies and collaboratives can learn from and collaborate with the Delaware Primary Care Reform Collaborative to draw larger, nationwide alignment on value-based care solutions.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://dhss.delaware.gov/dhss/dhcc/

collab.html

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Community-Based Organizations

Community-Based Organizations

Government Regulation and Guidance

Cures Act Final Rule for Data Sharing

Initiative Description: The Office of the National Coordinator for Health Information Technology’s (ONC) Cures Act Final Rule aims to promote secure access, exchange, and use of electronic health information. The Act accelerates the uptake of standardized application programming interfaces (APIs), requires IT developers to provide API capabilities for population health management, and increases patient access to electronic health information.

Strategic and Tactical Uses: This rule helps to standardize the measure reporting process by promoting interoperability and enabling access to patient-level data from health plans, providers, and patients. Organizations should continue to track ongoing updates to the data sharing infrastructure.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.healthit.gov/buzz-blog/category/21st-century-cures-act

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Community-Based Organizations

Community-Based Organizations

Collaboratives and Innovative Partnerships

Covered California’s Quality Transformation Initiative

Initiative Description: Covered California’s Quality Transformation Initiative (QTI) is focused on improving care for a small number of clinically important conditions for which there are major opportunities for improvement and established measures in current use. The four clinical areas of focus for improvement that are subject to Quality Transformation Fund payments are Controlling High Blood Pressure, Comprehensive Diabetes Care: Hemoglobin A1c Control, Colorectal Cancer Screening, and Childhood Immunization Status. Qualified Health Plan (QHP) issuers that fail to meet specified measure benchmarks will be required to make payments to the Quality Transformation Fund. For Measurement Year 2023, QHP final scores will be confirmed in September 2024, and issuer performance will be finalized and published by Spring 2025.

Strategic and Tactical Uses: QHP issuers in California can join the QTI to benefit from the financial incentives and quality measure improvements. For QHP issuers outside of California or other state agencies, this initiative can be used to set a baseline for financial incentives and quality measure alignment.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://hbex.coveredca.com/stakeholders/

plan-management/qti/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers

Providers

Collaboratives and Innovative Partnerships

Core Quality Measures Collaborative Measure Sets

Initiative Description: The Core Quality Measures Collaborative (CQMC) develops and releases core sets of quality measures for 10 clinical focus areas (primary care, behavioral health, cardiology, gastroenterology, Human Immunodeficiency Virus/Hepatitis C, medical oncology, neurology, obstetrics and gynecology, orthopedics, and pediatrics). CQMC Workgroups convene on an annual basis to update the existing core sets, conduct yearly maintenance, and hear from a broad-based coalition of health care leaders to gain different perspectives on the measures and consider new ones.

Strategic and Tactical Uses: Organizations can compare the CQMC measure sets with other aligned sets to identify overlap and prioritize measures for multi-payer implementation initiatives. Organizations should also look to CQMC’s non-primary care measure sets with partners to increase industry alignment in specialty care.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://www.qualityforum.org/CQMC_

Core_Sets.aspx

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Purchasers

Purchasers

Collaboratives and Innovative Partnerships

Colorado Social Health Information Exchange (SHIE)

Initiative Description: The Colorado State Health Information Exchange (SHIE) will be a network of social health data, insights, and resources that helps people understand and access the best path to positive health outcomes. The state is actively building a unifying architecture that provides a secure overarching network for the sharing of health information between providers. Regional hubs are also part of the SHIE program and will ensure that SHIE development is driven by the needs and priorities of people in Colorado.

Strategic and Tactical Uses: Colorado providers will be able to use SHIE to meet their patients’ holistic needs more effectively, reduce administrative burden, and improve care utilization. The Office of eHealth Innovation (OeHI) is developing their regional health approach and will be soliciting applications from community care organizations seeking to share data through the architecture. Organizations across the health care industry can stay informed on OeHI’s progress by attending webinars and reviewing the Office’s helpful resources.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing, Whole Person Care

Timeframe: Upcoming

For additional information, please visit https://oehi.colorado.gov/SHIE

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations

Enabling Organizations

Collaboratives and Innovative Partnerships

Colorado Primary Care Payment Reform Collaborative

Initiative Description: Created through HB 19-1233 and convened by the Division of Insurance (DOI), the Colorado Primary Care Payment Reform Collaborative (PCPRC) has been meeting since July of 2019. The PCPRC focuses on developing strategies for increased investments in primary care and advises on the development of affordability standards and targets for carrier investments in primary care. The PCPRC is also working on strategies to reduce health care costs, implement evidence- and value-based incentives, direct resources to the patients and practices that need increased capacity, and sustain advanced primary care delivery models.

Strategic and Tactical Uses: The Collaborative has open meetings for members of the health care community to join and advocate for primary care strategies. Active members of the Colorado health care community are encouraged to join the Collective and influence the future of primary care payment reform in Colorado. Health plans, providers, and other organizations from other states can build a group like Colorado’s to align on primary care payment goals in their state.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Performance Measurement and Reporting, Whole Person Care, Providing and Leveraging Technical Assistance

Timeframe: Active

For additional information, please visit https://doi.colorado.gov/insurance-products/health-insurance/health-insurance-initiatives/primary-care-payment-reform

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Community-Based Organizations

Community-Based Organizations

Government Regulation and Guidance

Civitas Networks for Health

Initiative Description: Civitas Networks for Health (Civitas) brings together organizations that focus on improving health in communities throughout the country through data-led multi-stakeholder collaboration. Civitas focuses on increasing collaboration and shared learning, providing thought leadership and technical expertise, and educating public and private entities about the benefits, functions, and roles of Civitas’ community. Members and topics include all-payer claims databases, health information exchanges, regional health improvement collaboratives, quality improvement organizations, and the emerging Health Data Utility model.

Strategic and Tactical Uses: Organizations can become members of Civitas to participate in multi-site workgroups and projects alongside organizations in pursuit of advancing interoperability and data-sharing alignment. Organizations can also learn about relevant reports, resources, and policy briefings.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.civitasforhealth.org/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Policy Makers

Policy Makers

Government Regulation and Guidance

Centers for Medicare & Medicaid Services Medicaid Child Core Sets

Initiative Description: The Children’s Health Insurance Program Reauthorization Act of 2009 (CHIPRA) included provisions to strengthen the quality of care provided to and health outcomes of children in Medicaid and the Children’s Health Insurance Program (CHIP). It required the Department of Health and Human Services (HHS) to identify and publish a core measure set of children’s health care quality measures for voluntary use by state Medicaid and CHIP programs and to review and update the list annually. Beginning in 2024, all states are required to report on the Child Core Set, which will continue to be updated annually.

Strategic and Tactical Uses: Organizations can compare the Medicaid Child Core Set with other aligned measure sets in use, to identify overlap and prioritize measures for multi-stakeholder implementation initiatives.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://www.medicaid.gov/medicaid/quality-of-care/performance-measurement/adult-and-child-health-care-quality-measures/childrens-health-care-quality-measures/index.html

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Enabling Organizations |

Enabling Organizations | ![]() Policy Makers

Policy Makers

Government Regulation and Guidance

Centers for Medicare & Medicaid Services Meaningful Measures Initiative

Initiative Description: The Meaningful Measures Initiative addresses measurement gaps, reduces burden, and increases efficiency by: (1) Using only high-value quality measures impacting key quality domains; (2) Aligning measures across value-based programs and across partners, including the Centers for Medicare & Medicaid (CMS), federal, and private entities; (3) Prioritizing outcome and patient-reported measures; (4) Transforming measures to be fully digital and incorporating all-payer data; (5) Developing and implementing measures reflecting social drivers/determinants of health (SDOH).

Strategic and Tactical Uses: Organizations can look toward the Meaningful Measures Initiative when developing their measure strategy. Industry movement toward similar goals (e.g., digital quality measurement) helps reduce fragmentation.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://www.cms.gov/medicare/quality/

meaningful-measures-initiative

Who Might Use This: ![]() Health Plans

Health Plans

Government Regulation and Guidance

Centers for Medicare & Medicaid Services Medicaid Adult Core Sets

Initiative Description: The Social Security Act (Section 1139B) requires the Department of Health and Human Services (HHS) to identify and publish a core set of health care quality measures for adult Medicaid enrollees and to review and update the list annually. The Adult Core Set includes a range of quality measures encompassing both physical and behavioral health. Beginning in 2024, all states are required to report on the behavioral health measures of the Adult Core Set, which will continue to be updated annually.

Strategic and Tactical Uses: Organizations can compare the Medicaid Adult Core Sets with other aligned measure sets in use, to identify commonalities and prioritize measures for multi-stakeholder implementation initiatives.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://www.medicaid.gov/medicaid/quality-of-care/performance-measurement/adult-and-child-health-care-quality-measures/adult-health-care-quality-measures/index.html

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Enabling Organizations

Enabling Organizations

Collaboratives and Innovative Partnerships

California Advanced Primary Care Initiative

Initiative Description: The California Quality Collaborative (led by the Purchaser Business Group on Health) and the Integrated Healthcare Association convene purchasers, health plans, and providers in California to strengthen the primary care delivery system. As part of this effort, health plans signed a Memorandum of Understanding (MOU) that commits them to shared primary care measures and a roadmap to advancing primary care in California. The Initiative culminates with the Payment Model Demonstration Project (July 2024-December 2025) to test a common value-based payment model with approximately 30 independent practices.

Strategic and Tactical Uses: The Initiative represents a multifaceted pilot that requires coordinated measure implementation, data sharing, and trust. In order to further statewide alignment, additional organizations in California are encouraged to sign the MOU and join the Initiative. Non-California health plans can use the MOU as a blueprint to build similar collaboratives in their state. The Advanced Primary Care Measure Set and Roadmap to Advanced Primary Care are also available for organizations looking to better align their primary care services.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Performance Measurement and Reporting, Technical Assistance, Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.pbgh.org/initiative/ca-advanced-primary-care-initiative/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers

Providers

Government Regulation and Guidance

Medicaid and Children’s Health Insurance Program

Managed Care Access, Finance and Quality Final Rule

Initiative Description: On April 22, 2024, Medicaid and Children’s Health Insurance Program (CHIP) finalized two key regulations: “Ensuring Access to Medicaid Services” (Access Rule) and “Medicaid, CHIP Managed Care Access, Finance, and Quality” (Managed Care Rule), aimed at improving access to care in Medicaid across delivery systems (fee-for-service and managed care) and authorities (state plan and waiver services). The Managed Care Rule addresses five primary areas: (1) access in managed care, including network adequacy, (2) state directed payments, (3) medical loss ratio standards, (4) in lieu of services and settings (ILOSs), and (5) quality and performance assessment.

Strategic and Tactical Uses: The new rule will improve how managed care plans serve their members. Plans will need to collaborate closely with providers to implement the requirements of the rule.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.medicaid.gov/medicaid/

managed-care/guidance/medicaid-and-chip-managed-care-final-rules/

index.html

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers |

Providers | ![]() Policy Makers

Policy Makers

Michael de la Guardia is the Deputy Director of the Division of Health Plan Innovation (DHPI) in the Seamless Care Models Group (SCMG) within the Center for Medicare and Medicaid Innovation at the Centers for Medicare & Medicaid Services (CMS); the division currently houses Medicare Advantage models. Michael also co-leads the Center’s portfolio of climate change and health initiatives. Prior to his role as Deputy Director of DHPI, Michael was the Value-Based Insurance Design (VBID) Model Co-Lead. He previously worked at the United States Senate Committee on Finance as a Health Policy Fellow focused on the Inflation Reduction Act and Medicare and Medicaid legislation and hearings. Michael received a B.S. from the Georgia Institute of Technology and an M.P.H. and M.B.A. from the University of California (UC), Berkeley.

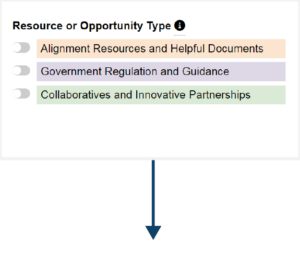

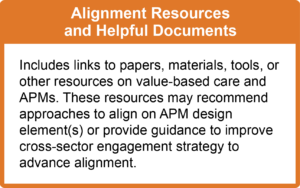

Includes links to papers, materials, tools, or other resources on value-based care and APMs. These resources may recommend approaches to align on APM design element(s) or provide guidance to improve cross-sector engagement strategy to advance alignment.

Collaboratives and Convening Organizations – Includes organizations bringing together various stakeholders to support multi-payer alignment and/or value-based care. Each collaborative may serve a slightly different purpose but can be leveraged as a convening opportunity for a shared region or goals.

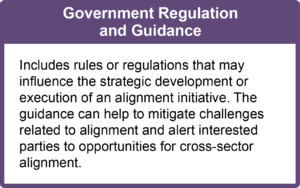

Government Regulation and Guidance – Includes rules or regulations that may influence the strategic development or execution of an alignment initiative. The guidance can help to mitigate challenges related to alignment and alert interested parties to opportunities for cross-sector alignment.

Innovative Initiatives and Partnerships – Includes examples of ongoing work to advance alignment efforts and innovate health care payment. Some of these efforts are open to public participation, while others may be geographically or time bound.

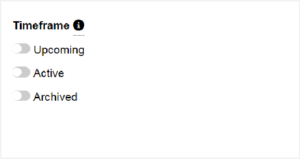

Upcoming: Initiatives or resources that are expected to start or be released in the near future.

Active: Initiatives or resources that are relevant and ongoing.

Archived: Initiatives or resources that are no longer active but are memorialized as content that has previously been included in the Landscape.

COO – Reginald Vicks, RN, BSN, MBA brings more than 27 years of healthcare leadership experience, mid-level and executive, to oversee and monitor the Agency’s multi-site specific programs and operations. Mr. Vicks is a Registered Nurse with experience in healthcare management for both acute care and community-based settings. His professional background includes direct patient care nursing & healthcare management, along with oversight of clinical operations. Prior to coming to CrescentCare, Reginald served as the director of the Emergency and Critical Care Services for New Orleans East Hospital. Mr. Vicks brings experience in operations, policy and procedure development, staffing management and equipment procurement, as well as training, research and the use of an evidence-based practice model of care delivery. His experience with start-up processes as New Orleans and its hospitals rebuilt after Hurricane Katrina assists CrescentCare as it continues to expand.

Government Regulation and Guidance

Alternative Payment Model Performance Pathway

Initiative Description: The Alternative Payment Model (APM) Performance Pathway (APP) is an optional Merit-based Incentive Payment System (MIPS) reporting and scoring pathway for MIPS-eligible clinicians who are also participants in MIPS APMs. Performance is measured across three areas: quality, improvement activities, and promoting interoperability. The idea behind the measure set is to reduce burden, create new scoring opportunities for participants in MIPS APMs, and encourage participation in APMs through alignment.

Strategic and Tactical Uses: APM entities in a MIPS APM may report the APP on behalf of their MIPS-eligible clinicians. Accountable Care Organizations (ACOs) participating in the Medicare Shared Savings Program are required to report the APP for the purpose of assessing their quality performance for that program. Groups and individuals may also report the APP on behalf of their MIPS-eligible clinicians.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components, Performance Measurement and Reporting

Timeframe: Active

For additional information, please visit https://qpp.cms.gov/mips/apm-performance-pathway

Who Might Use This: ![]() Providers

Providers

Collaboratives and Innovative Partnerships

Arkansas’s Multi-state, Multi-payer Collaborative

Initiative Description: Since 2011, Arkansas Blue Cross and Blue Shield, Blue Cross and Blue Shield of Kansas City, and Blue Cross and Blue Shield of Oklahoma (BCBS health plans) have engaged in a regional, multi-payer learning and technical assistance effort. The effort started as an initiative to stay connected, share lessons learned, and demonstrate best practices related to the Comprehensive Primary Care Initiative, but now the Collaborative has spanned two additional Innovation Center models (Comprehensive Primary Care Plus and Primary Care First). The multi-state effort has continued to grow organically beyond the models and BCBS health plans.

Strategic and Tactical Uses: Regional health plans in Arkansas, Oklahoma, and the Kansas City area participate in the multi-state, multi-payer Collaborative and are involved in alignment efforts for quality measures, technical assistance, and information exchange. Health plans outside of the area can use the collaborative as an example of regional plans coming together to align and can explore forming a Collaborative in their own region.

Multi-payer Alignment Foundational Element: Performance Measurement and Reporting, Whole Person Care, Timely and Consistent Data Sharing, Providing and Leveraging Technical Assistance

Timeframe: Active

For additional information, please email Alicia Berkemeyer (amberkemeyer@arkbluecross.com) or Adam Whitlock (mawhitlock@arkbluecross.com).

Who Might Use This: ![]() Health Plans

Health Plans

Government Regulation and Guidance

2025 Hospital Inpatient Prospective Payment System and Long-Term

Care Hospital Prospective Payment System Final Rule

Initiative Description: On August 1, 2024, the Centers for Medicare & Medicaid Services (CMS) issued the fiscal year (FY) 2025 Medicare hospital inpatient prospective payment system (IPPS) and long-term care hospital prospective payment system (LTCH PPS) final rule.

Strategic and Tactical Use: The new rule will update Medicare fee-for-service payment rates and policies for inpatient hospitals and LTCHs for FY 2025. CMS is publishing this final rule to meet the legal requirements to update Medicare payment policies for IPPS hospitals and LTCHs on an annual basis.

Multi-payer Alignment Foundational Element: Aligning Key Payment Model Components

Timeframe: Active

For additional information, please visit https://www.cms.gov/newsroom/fact-sheets/fy-2025-hospital-inpatient-prospective-payment-system-ipps-and-long-term-care-hospital-prospective

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Providers

Providers

Innovative Initiatives and Partnerships

Core Quality Measures Collaborative Measure Sets

Initiative Description: The Core Quality Measures Collaborative (CQMC) develops and releases core sets of quality measures for 10 focus areas. The CQMC Workgroups convene on an annual basis to update the existing core sets, conduct yearly maintenance, and dialogue with members from a variety of stakeholder groups to gain different perspectives on the measures and consider new ones.

Strategic and Tactical Uses: Organizations can compare the CQMC Measures Collaborative Core Measure Sets with other aligned measure sets in use to identify overlap and prioritize measures for multi-payer implementation initiatives.

Multi-payer Alignment Foundational Element: Performance Measurement

Timeframe: Active

For additional information, please visit https://www.qualityforum.org/CQMC_Core_Sets.aspx

Who Might Use This: ![]() Payers |

Payers | ![]() Providers |

Providers | ![]() Purchasers

Purchasers

Collaboratives and Innovative Partnerships

California Health and Human Services

Data Exchange Framework

Initiative Description: The Data Exchange Framework (DxF) is an agreement across health and human services systems and providers to share information safely and effectively. The Framework aims to make data available to drive decisions and outcomes, promote individual data access, reinforce data privacy and security, and establish clear and transparent terms and conditions for data collection, exchange, and use. Starting January 2024, health care entities are required to exchange real-time information with each other and with public health and social services for treatment, payment, and health care operations.

Strategic and Tactical Uses: California organizations are required to use the Framework to communicate with each other regarding the sharing of patient data. States outside of California can apply a similar data exchange framework to improve data sharing for their own populations.

Multi-payer Alignment Foundational Element: Timely and Consistent Data Sharing

Timeframe: Active

For additional information, please visit https://www.cdii.ca.gov/committees-and-advisory-groups/data-exchange-framework/

Who Might Use This: ![]() Health Plans |

Health Plans | ![]() Purchasers |

Purchasers | ![]() Providers |

Providers | ![]() Policy Makers |

Policy Makers | ![]() Community-Based Organizations |

Community-Based Organizations | ![]() Enabling Organizations

Enabling Organizations

The Alignment Landscape includes a search bar and three filters to help narrow down items that are relevant to your alignment goals.

Filters:

![]() The Timeframe section

The Timeframe section

filters by upcoming, active and archived opportunities and resources:

![]() The Resource or Opportunity Type section filters by initiatives and resources which are categorized into the following three groups:

The Resource or Opportunity Type section filters by initiatives and resources which are categorized into the following three groups:

![]() The Multi-Payer Alignment Foundational Elements section filters by key features of multi-payer initiatives, defined by the Duke-Margolis Institute for Health Policy.

The Multi-Payer Alignment Foundational Elements section filters by key features of multi-payer initiatives, defined by the Duke-Margolis Institute for Health Policy.

Each card includes background information on the alignment opportunity, including anticipated strategic and tactical uses and audience, associated foundational element(s), timeframe, and where to find additional information.

The Alignment Landscape includes a search bar and three filters to help narrow down items that are relevant to your alignment goals.

Filters:

![]()

The Timeframe section filters by new, upcoming and archived opportunities and resources:

![]()

The Resource or Opportunity Type section filters by initiatives and resources which are categorized into the three following groups:

![]()

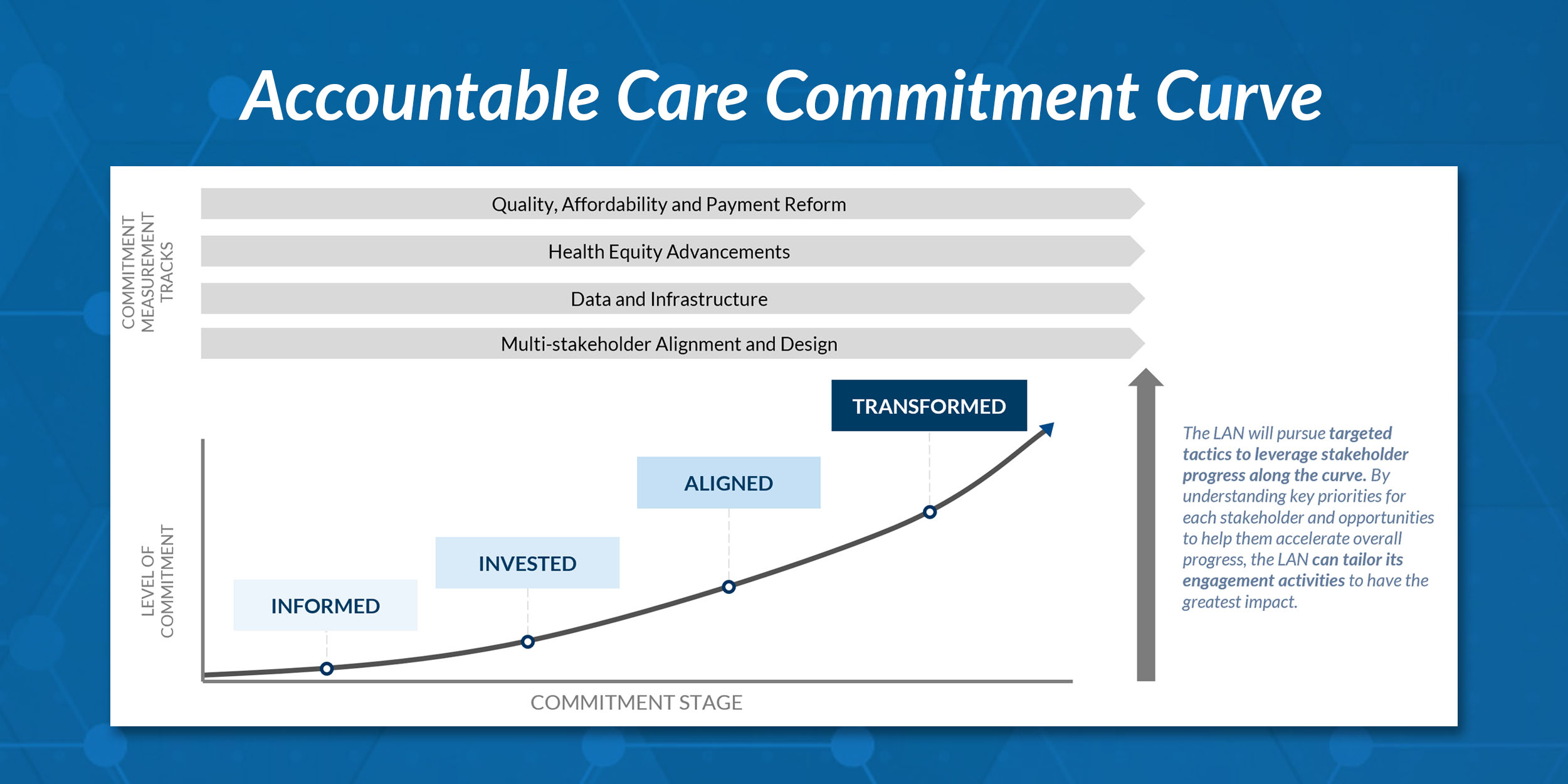

The Multi-payer Alignment Foundational Elements section filters by the Accountable Care Curve Measurement.

[gravityform id=”38″ title=”true” description=”true”]

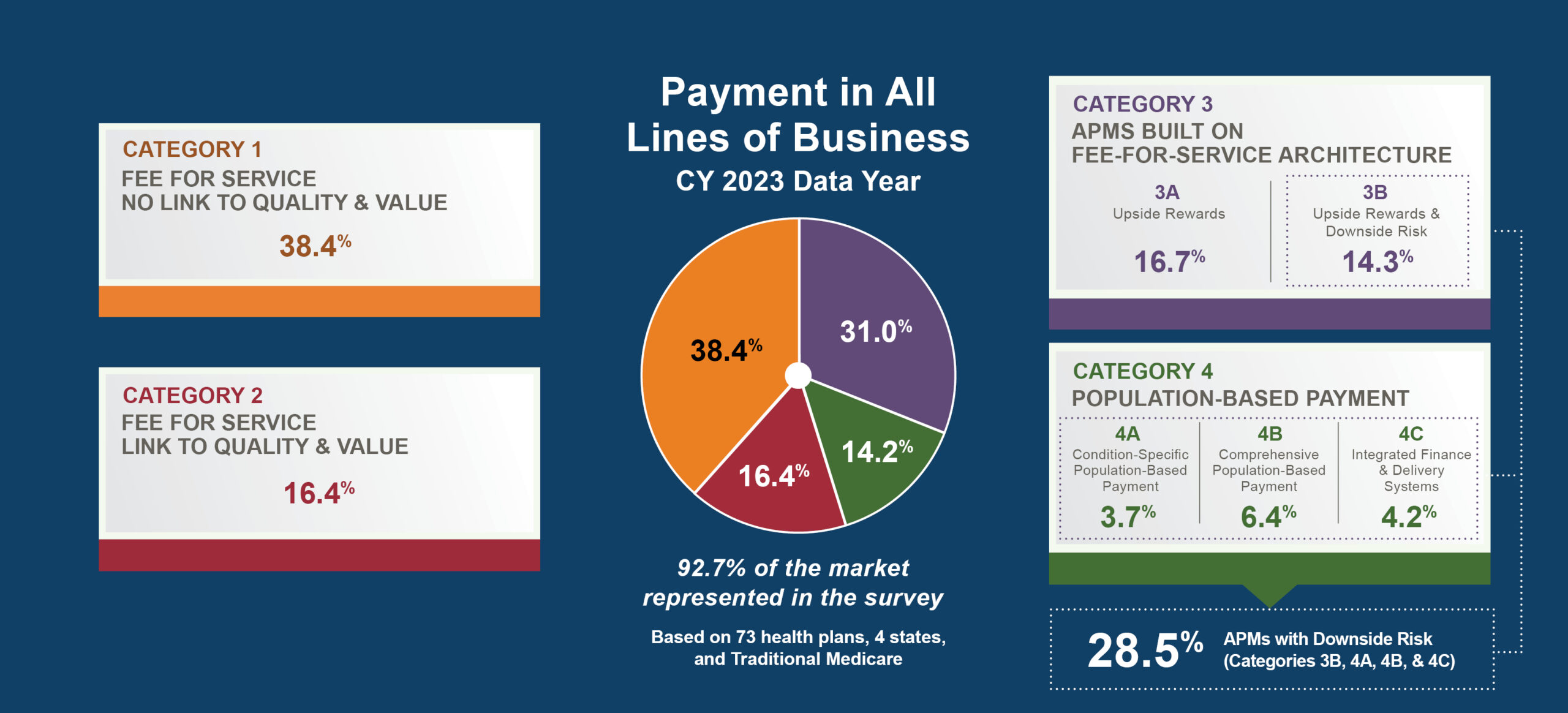

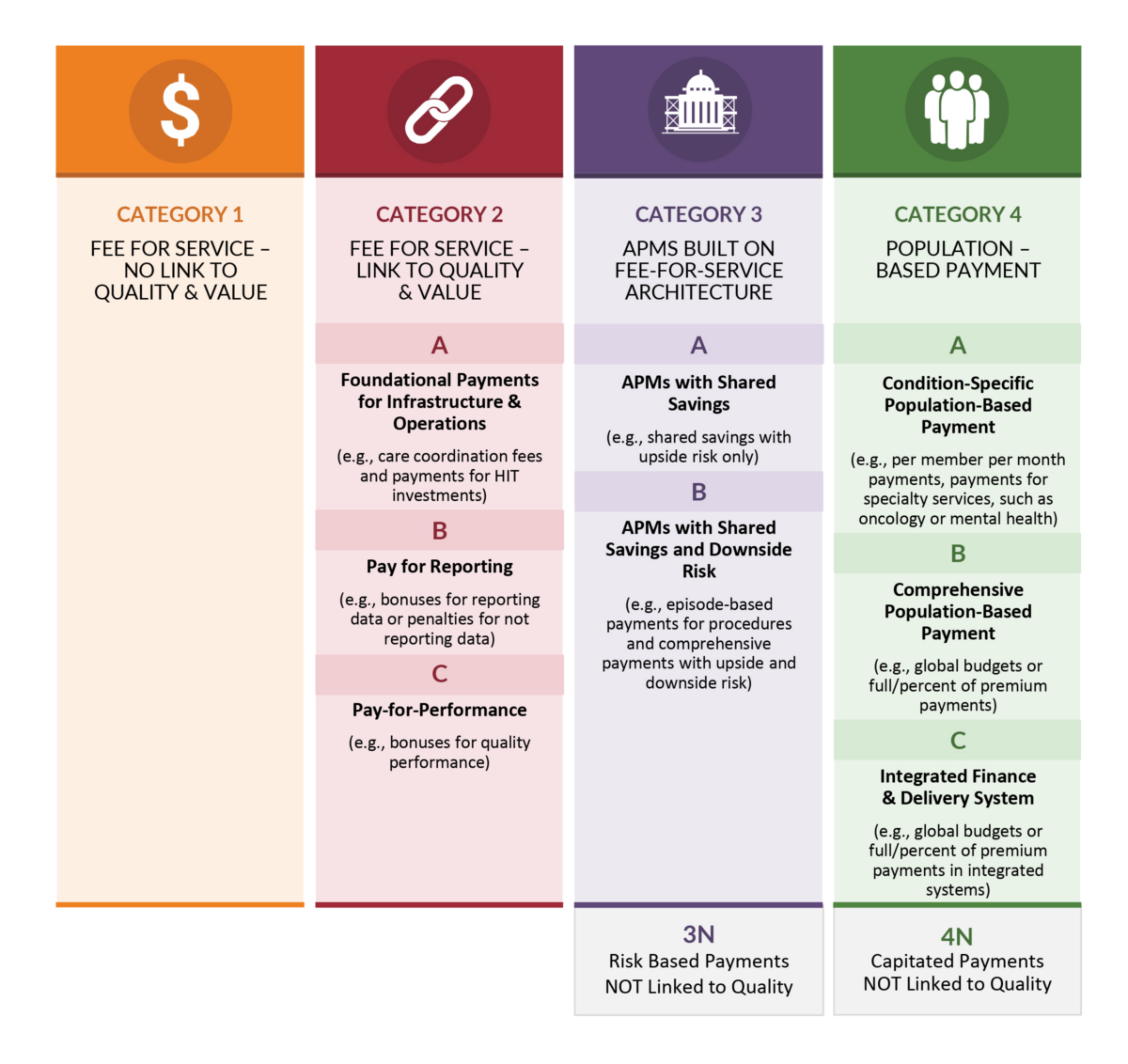

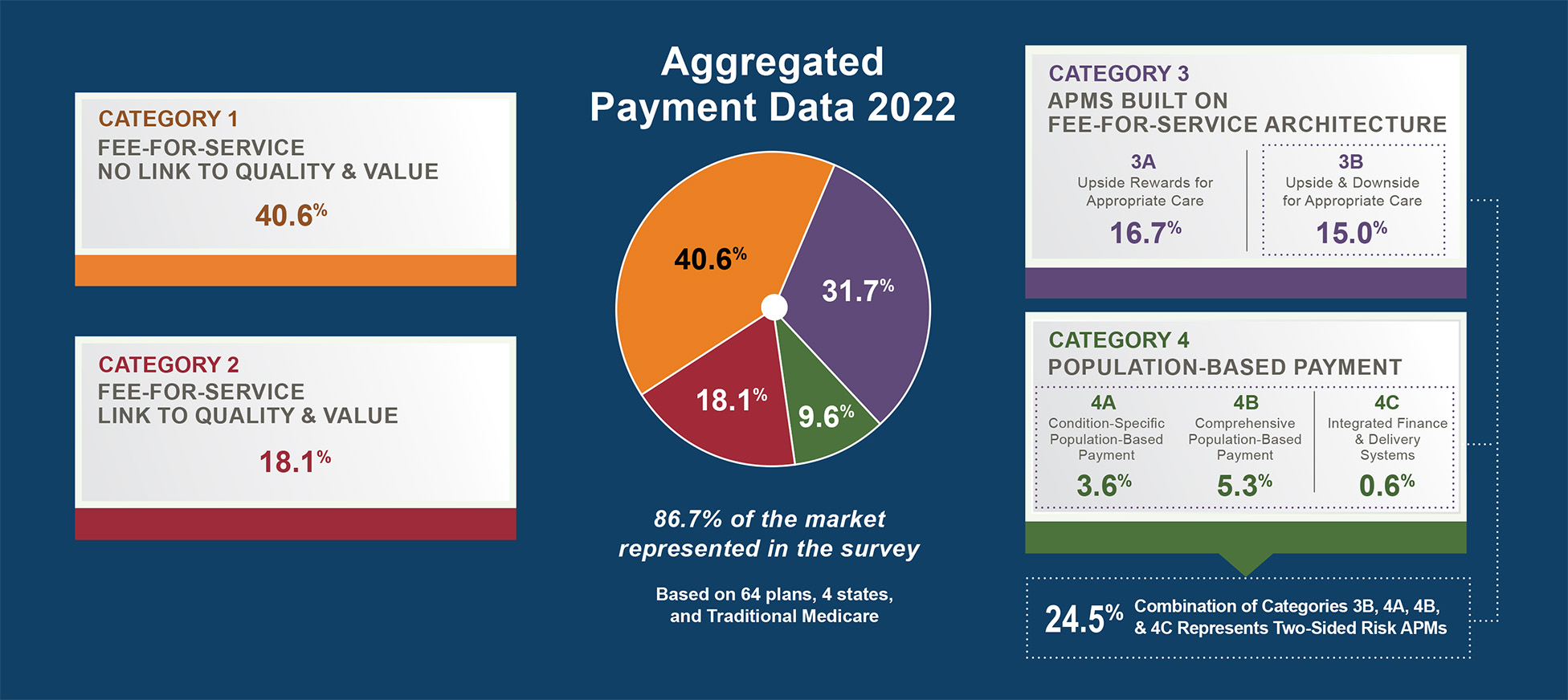

Download accessible PDF of 2023 APM Measurement Report

Maria Ramirez Perez is a Program Manager with NC Medicaid’s Healthy Opportunities Pilots program and leads the program’s efforts with Network Leads and community-based organizations. Prior to her work with NC HOP, she also co-led the implementation of NC DHHS’s COVID-19 Support Services Program which helped connect households with social supports to safely quarantine or isolate.

Maria previously worked with Legal Aid of North Carolina where she represented clients in public benefits appeals. She also led regional implementation and outreach efforts to help North Carolinians gain access to clinical care and social supports through the Medical-Legal Partnership and Healthcare Navigator programs.

Maria earned her Master of Public Health from UNC Gillings School of Global Public Health. When she is not focused on addressing healthy opportunities, Maria is trying new recipes or exploring the outdoors. She has logged hundreds of miles hiking in the southeast.

Kate Davidson, LCSW is the director of the learning and diffusion group (LDG) at the Center for Medicare and Medicaid Innovation (CMMI), within the Centers for Medicare & Medicaid Services (CMS). In this role, Ms. Davidson leads CMMI’s team focused on accelerating healthcare system transformation by leveraging improvement science within and across models, as well as leading the multi-payer alignment strategy for the Center through the Health Care Payment Learning and Action Network (HCPLAN). Prior to joining CMS, Ms. Davidson led Policy and Practice Improvement efforts at the National Council for Mental Wellbeing, where she managed payment reform, quality improvement, and workforce development initiatives in mental health and addiction prevention, treatment, and recovery organizations, and provided training and technical assistance to human services organizations, counties, and states. Ms. Davidson began her career in healthcare as a social worker researching, testing, and scaling interventions in community-based settings. Ms. Davidson has an MSW from Fordham University and a BA from Loyola College in Maryland.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.

Dr. Walsh is an Aerospace Medicine Specialist, who provided primary care to aircrew and special operational personnel and their families during much of his 21-year active duty career in the U.S. Air Force. Upon retirement in 2006 he served as an Urgent Care Physician at the previous Memorial Health System in Colorado Springs between 2006 and 2008 and practiced at the Centura Center for Occupational Medicine in Colorado Springs, CO and Pueblo, CO between 2006 and 2009.

His prior positions include serving as the Chief Medical Officer, South State Operating Group of Centura Health, Corporate Chief Medical Executive for Centura Health in Denver, Colorado, and the VP of Medical Affairs at St. Francis Medical Center in Colorado Springs, Colorado.

Dr. Walsh received his B.A. at the University of Southern California, his M.D. from the Medical College of Ohio in Toledo, Ohio, and a M.P.H. from Harvard School of Public Health. He completed his residency in Aerospace Medicine at the USAF School of Aerospace Medicine at Brooks AFB, Texas.

Jeff Micklos, J.D., is the executive director of the Health Care Transformation Task Force. An attorney by training, Jeff is the former executive vice president of Management, Compliance & General Counsel for the Federation of American Hospitals, a national trade association representing investor-owned hospitals. He is also a former partner in the Health Law department of the international law firm Foley & Lardner LLP. Jeff began his career as a litigator and regulatory counsel for the Health Care Financing Administration of the U.S. Department of Health and Human Services. Additionally, Jeff served in the Office of General Counsel of the Social Security Administration.

Jeff is a graduate of the Catholic University of America’s Columbus School of Law. He received a Bachelor of Arts from Villanova University. He resides in Washington, D.C., with his wife, Monica, and their four children.

Ms. Nedhari brings more than 18 years of experience in community organizing, reproductive justice, and program development. She is a mother, licensed Certified Professional Midwife, Family Counselor, and the Co-founding Executive Director of Mamatoto Village. Aza is a fiercely dedicated woman who believes that by promoting a framework of justice, the reduction of barriers in maternal and child health begins to dissipate; giving rise to healthy individuals, healthy families, and healthy communities. Aza is pursuing her Doctorate in Human Services with a concentration in Organizational Leadership and Management with an eye towards the sustainability of Black led organizations and cultivating innovative models of perinatal care delivery and workforce development.

Timothy P. McNeill is the founder of Freedmen’s Health, a Washington, DC healthcare consulting firm specializing in implementation of innovative models of care. Mr. McNeill also serves as the co-chair of the Partnership to Align Social Care. The Partnership to Align Social Care is a multi-sectoral group of health plans, health systems, community-based organizations and Government liaisons that work together to identify and address priority issues that are essential to a fully aligned health and social care system that incorporates the vital voice of the community.

Mr. McNeill has started or expanded multiple sustainable health programs including two Medicare Shared Savings Program (MSSP) ACOs, an IPA made up of FQHCs and independent physicians, a network of community-based free clinics, managed the operations of a network of Federally Qualified Health Centers, and established multiple regional networks to deliver Long-Term Services and Supports, contracting with MCOs, in support of State Medicaid Waiver implementation.

Mr. McNeill is a Registered Nurse with a bachelor’s degree from Howard University and a Master of Public Health from Eastern Virginia Medical School. Mr. McNeill is also a retired U.S. Navy Nurse Corps Officer.

Sam oversees food programs and systems change work at Reinvestment Partners, an anti-poverty non-profit based in Durham NC. She manages a $10m produce prescription program portfolio; guides program evaluation with a focus on strategic impact; and contributes to advocacy that seeks to integrate non-medical health services into healthcare delivery.

Before joining Reinvestment Partners, Sam was the program evaluator and food systems lead for a SNAP-Education program at NC State University. She received an MS in Food Policy and Applied Nutrition from the Friedman School of Nutrition Science and Policy, and she brings a critical perspective to food work.

Mr. Joseph Strickland resides in southeast Alabama having lived in the Wiregrass region for most of his life. He holds a Master of Science degree from Troy University. Mr. Strickland serves as the Director of Home and Community Services at SARCOA Area Agency on Aging, where he has been employed for the past 22+ years. He is passionate about developing and implementing quality LTSS: Long Term Services and Supports, for the Aging population. He was instrumental in developing a model of delivery for LTSS case management that led to successful contracting with a managed care organization.

In addition, Mr. Strickland served as lead developer for a case management software system used by all AAAs in support of their Medicaid Waiver case management activities. The case management system now serves as the data warehouse, “system of record”, and centralized case management system for all Alabama AAA case management activities. The development and implementation of the case management system was pivotal in the Alabama AAA effort to demonstrate proficiency in case management activities as well as provide a platform to manage programs, staff, and enrollees.

In addition to his work in developing and managing the case management system used by the Alabama AAA network, Mr. Strickland also serves as the lead for organization efforts focused on National Committee for Quality Assurance (NCQA) Accreditation standards for CM-LTSS.

SARCOA was the first AAA in Alabama to become Accredited by the National Committee for Quality Assurance for CM-LTSS and was instrumental in leading all Alabama AAAs in their efforts to become accredited.

Supports the activation and empowerment of members and patients to improve their own care using a range of communication mediums (e.g., text, chat, secure email, and phone).

Measurement Track: Multi-stakeholder Alignment & Design

![]()

![]()

![]()

![]()

Capability: Cohesive digital referral and management platform

Measurement Track: Multi-stakeholder Alignment & Design

![]()

![]()