June 24, 2019

By: Jacqueline LaPointe

This post originally appeared on RevCycleIntelligence.com.

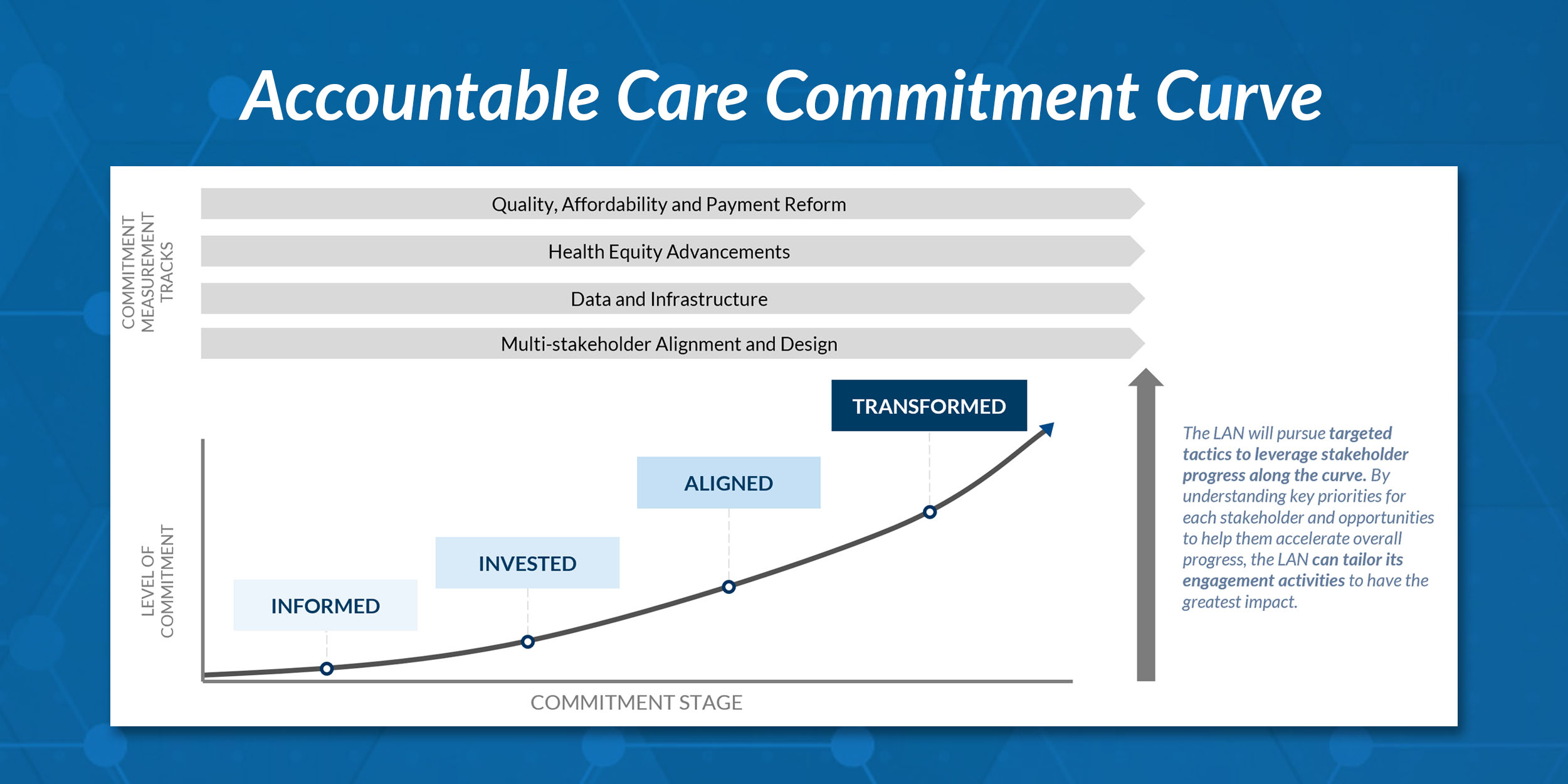

The healthcare industry is moving beyond just the development and adoption of alternative payment models (APMs), according to Aparna Higgins, a former leader at the Health Care Payment Learning and Action Network (HCP-LAN).

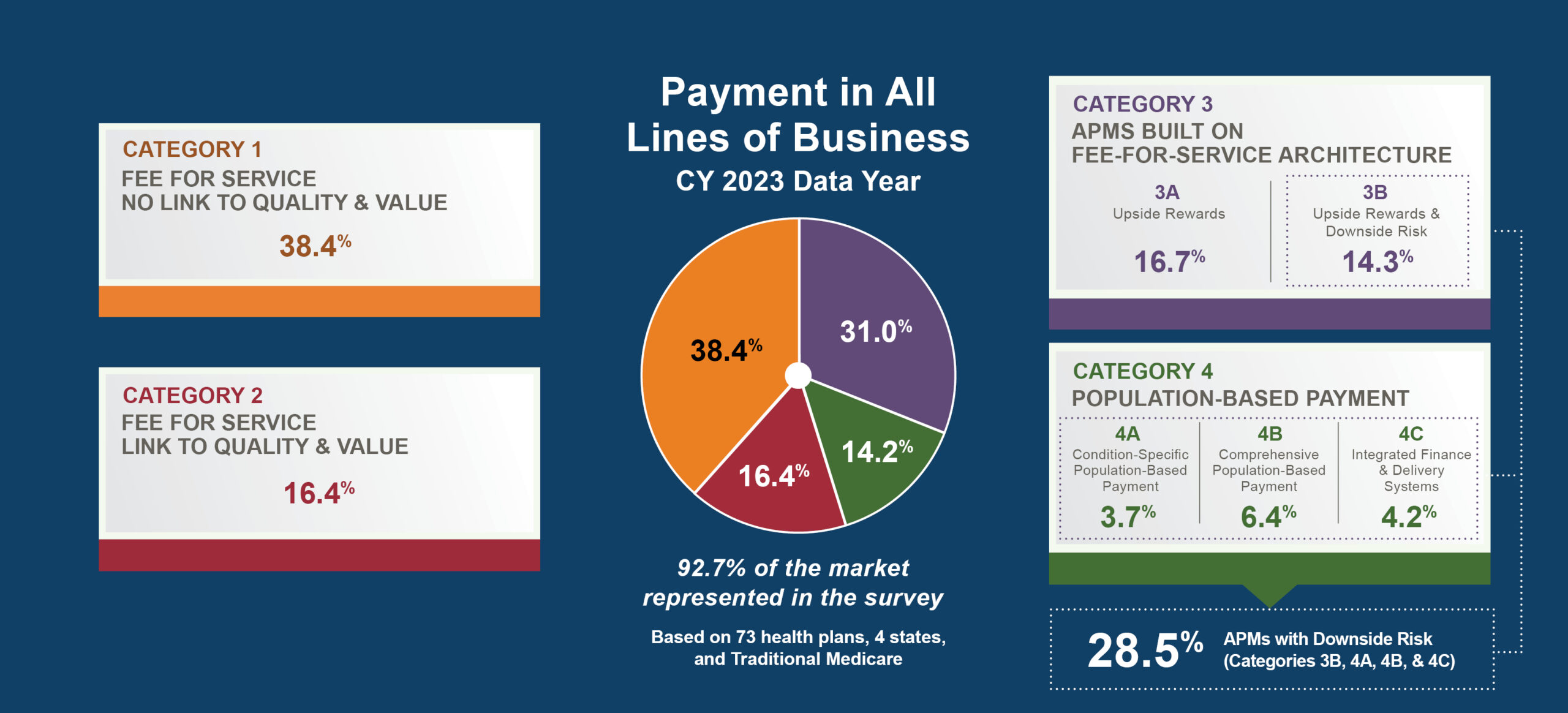

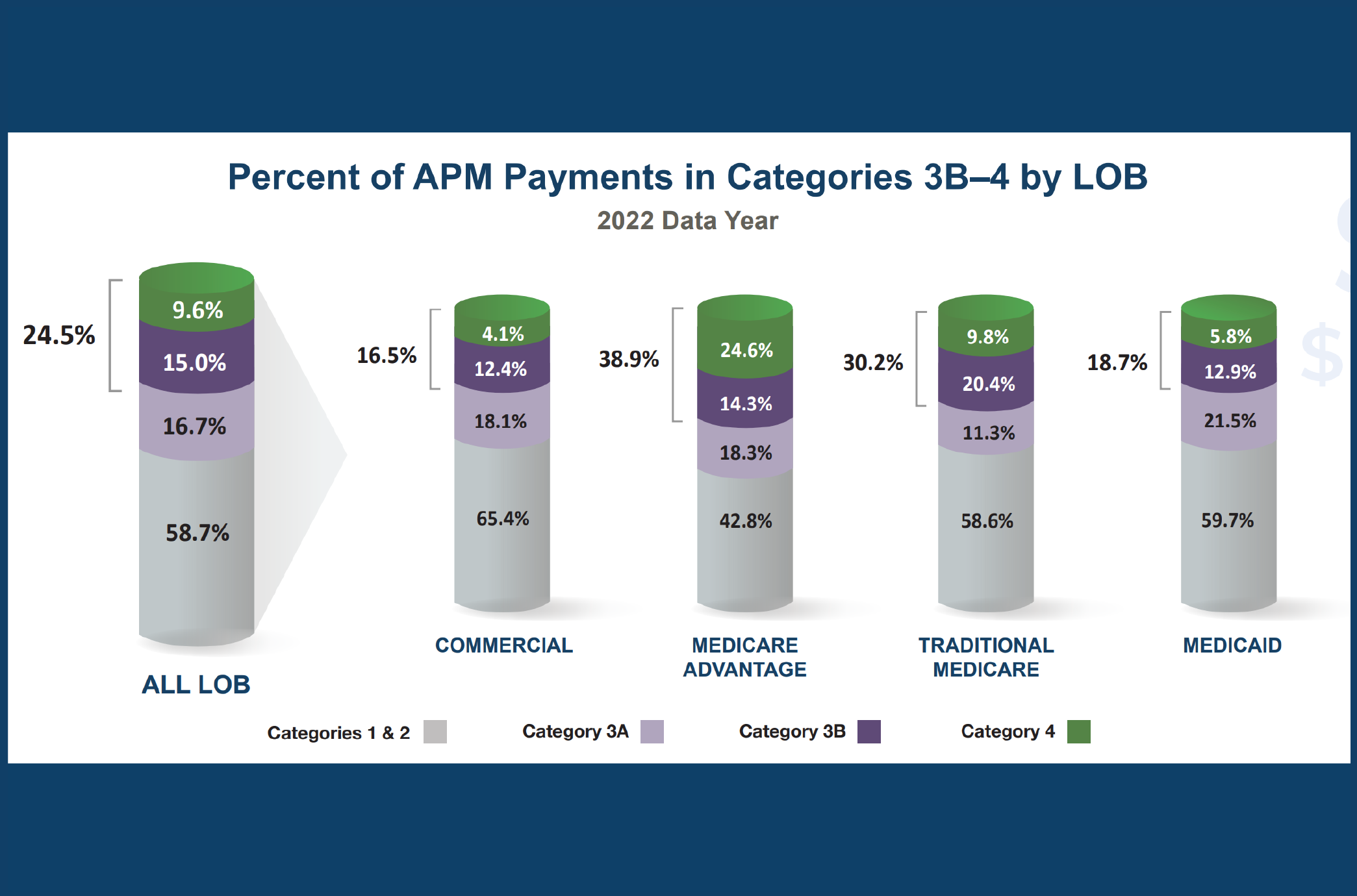

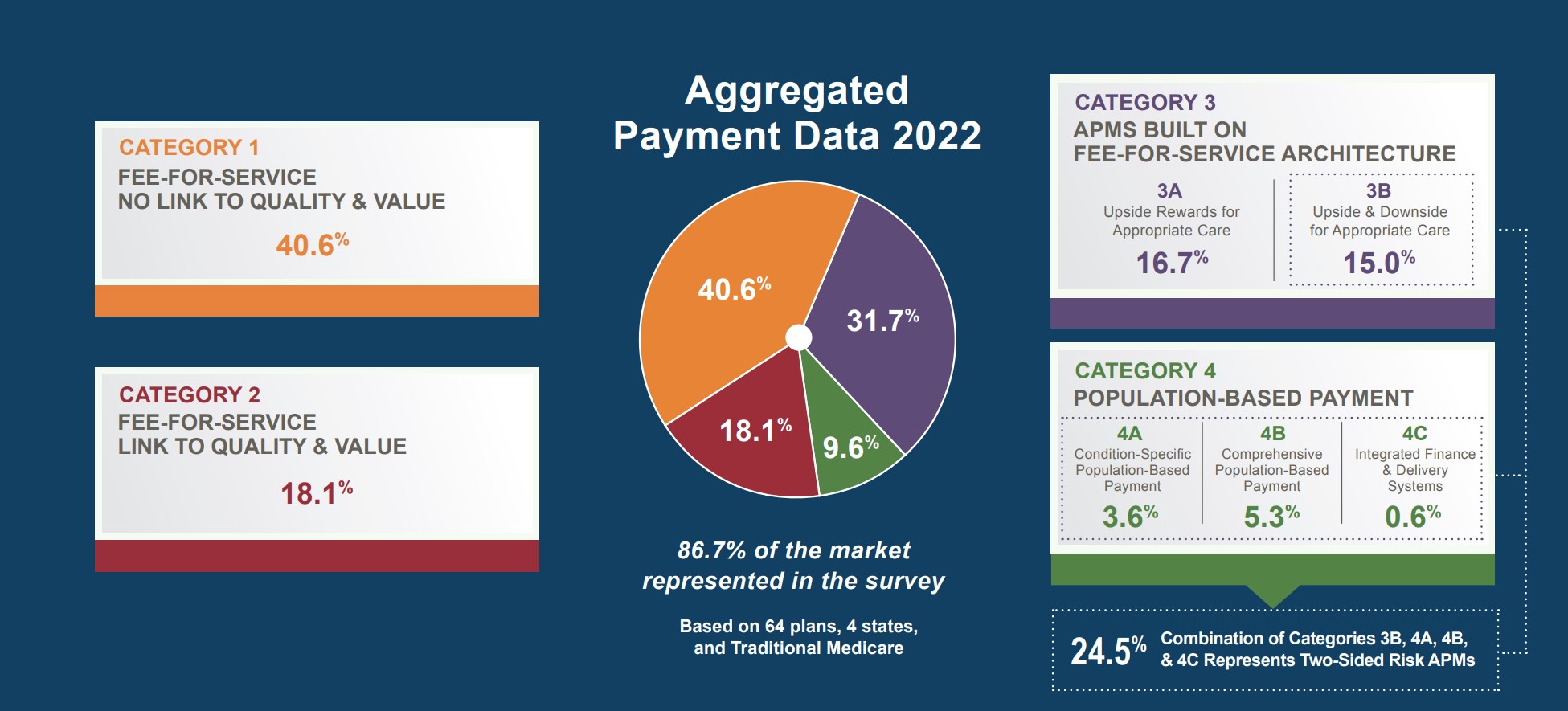

HCP-LAN is a public-private partnership that aims to accelerate the transition to value-based reimbursement and care through increased APM adoption. The organization recently found that just 41 percent of healthcare payments made by insurers covering 135 million lives in 2017 were paid through fee-for-service. Insurers tied the remaining payments to value, with about one-third of all payments linked to a formal APM.

While the industry is progressing with APM adoption, providers and payers need to start thinking about adopting models that do more than tie payment to value.

“We’re not just about pushing forward the adoption of APMs, we really want to identify successful APMs,” said Higgins, the current CEO of Ananya Health Innovations Inc. at AHIP’s Institute & Expo in Nashville. “Ultimately, we want to be able to give guidance to the field in terms of what works and what doesn’t work, so we can achieve the quadruple aim.”

So, what makes an alternative payment model successful at achieving the quadruple aim?

Higgins’ fellow panelists from major provider and payer organizations identified elements that have helped their organizations realize the benefits of APM adoption, including lower medical costs, higher care quality, and increased provider and patient satisfaction.

The other panelists included Andrea Gelzer, MD, MS, FACS, senior VP and corporate chief medical officer at AmeriHealth Caritas; Kim Kauffman, chief value-based care officer at Summit Medical Group and Summit Strategic Solutions; and Renee McLaughlin, national medical director of value-based relationships at Cigna Corporation.

FLEXIBILITY

Successful APMs not only provide payment flexibility, but also offer providers different options for participation, Gelzer told a room full of insurance executives and provider leaders.

AmeriHealth Caritas primarily serves low-income individuals through Medicaid, and Medicaid programs have been slow to adopt value-based reimbursement and APMs. In fact, HCP-LAN found in its most recent APM measurement report that only one-quarter of Medicaid payments made in 2017 were part of an APM.

“There has to be a variable payment opportunity for provider practices, especially those in Medicaid where the provider is getting the lowest of the fee schedules across the board. Cashflow can be a real, significant issue for them,” she said. “So, it’s important that you have flexibility not just in how you design the APM, but also in the way that you make sure payments are made on a regular basis.”

At AmeriHealth Caritas, Gelzer is trying to meet Medicaid providers where they are in terms of APM adoption to ensure all their providers are successful. The insurer is taking “a real flexible approach to how we pick the timelines to pay them and the advances to pay them, as well as the model.”

The insurer is also being flexible with data sharing to ensure success.

“As integrated delivery systems take on alternative payments, they’re developing their own systems to track data,” she explained. “But, with the smaller practices, FQHCs, providers who take care of Medicaid patients, it’s really important that you try to spoon feed data in chunks that are digestible to help them down the line.”

Through a web-based analytics tool, AmeriHealth Caritas is giving their smaller practices insights into their claims data on a monthly basis. Providers now have access to timely, actionable information, as well as faster payments because the insurer can settle contracts sooner.

LEADERSHIP AND CULTURE

Leadership and organizational culture is also essential to provider success in APMs, according to HCP-LAN’s “Roadmap for Driving High Performance in Alternative Payment Models.” And Cigna’s McLaughlin could not agree more.

“As we have grown our program through the years – we’re into our 11th year of managing ACOs and now have over 260 of these relationships – the one thing that bubbles to the surface that separates the successful relationships from those that have more opportunity, if you will, is leadership, culture, and engagement,” she said.

To implement successful APMs, payers and providers need to identify clinical and administrative leadership and make sure those leaders fully understand the model and its goals. Both clinical and administrative leaders need to commit to standardizing patient-centered, value-based care processes throughout the organization.

“With that commitment, we see success. Without that commitment, we see challenges,” she stressed.

Relatedly, leaders need to make their clinicians are aware of the APM and its financial implications, McLaughlin stated.

Oftentimes, clinicians are the last to know about important changes to how their organization receives revenue. For example, a 2018 analysis from Leavitt Partners found that only four percent of physicians said that they had an in depth knowledge of MACRA, Medicare’s largest initiative for moving providers to value.

“It doesn’t suffice for the chief medical officer or the chief clinical officer to have an understanding of the models whether it be a Cigna commercial model or the MSSP,” she told conference attendees.

“The folks who are actually delivering the care, be they physicians, mid-levels, support folks, they have to understand the model, too. They need to know what the values are, what the opportunities are, so there is that connection through all levels of the organization. That is absolutely critical.”

BENCHMARKING AND VALUE-BASED ALIGNMENT

As the only representative from a provider organization, Summit Medical Group’s Kauffman identified unique elements that make a successful APM. Those elements included benchmarking and multi-payer design.

The physician-owned medical group based in Tennessee receives about 20 percent of its revenue from APMs based on fee-for-service. But the group is working on advancing their APM participation as long as the models include appropriate benchmarking methodologies.

“In commercial contracting, one of the things that we require is the opportunity to do better than ourselves year over year and better than our region minus us,” she explained. “If I’m 40 percent of the region and you want to include me in the region, it’s a race to the bottom and that’s not fair. Or, if I can do better than the nation.”

Summit Medical Group actually quit the Medicare Shared Savings Program (MSSP) after failing to earn shared savings because of the model’s historical benchmarking methodology, Kauffman explained.

The group only decided to rejoin a Medicare accountable care organization (ACO) program after CMS offered regional benchmarking as part of the Next Generation model.

“There’s now a blend of regional and national,” she said regarding the Next Generation model. “If you are in a market that is historically low cost and 100 percent of the adjustment is based on national trends, you’re done. You’re toast. So, the introduction of the regional adjustments to the benchmarking and the risk adjustment that we can get for aging populations helps.”

Kauffman also emphasized the importance of developing APMs that can work for multiple payers.

“If you could see the spreadsheets that we have with all of the different quality metrics from our 19 different value-based programs with payers,” she stressed. “A couple of years ago, we decided we were going to pick a handful and create our own internal dashboard because you can’t boil the ocean. So, we focus on 18 and we apologize to the health plans because we can’t do everything.”

Creating APMs with standardized quality measures and reporting requirements can help providers succeed with value-based care. Multi-payer models prevent value-based care and APM adoption from becoming check-the-box programs.

But the industry will not get to widely adopting APMs with all the identified success elements without increased payer-provider collaboration, McLaughlin highlighted.

“How we work together, how we engage, is really critical,” she said. Successful APMs involve payers and providers sitting face-to-face on a regular basis to discuss best practices, opportunities for improvement, and sharing lessons learned.

“Ten years ago it was almost a foreign concept to have a payer and provider sitting on the same side of the table working together, but focusing on APMs really has helped us to change that relationship.”

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models.

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models. Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System.

Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System. Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.