“We need to ensure that we’re getting value for the health care we purchase, investing wisely in our employees and in their future with us.”

Jeff White is the Director of Health Care Strategy and Policy at The Boeing Company, a defense, space, and security business with over 160,000 employees in the US. In this role he leads a team responsible for health care benefits strategy, contract negotiations, and plan policy for $2.5 billion in annual spending. Jeff and his team take an active role in partnering with vendors, associations, and the provider community to explore innovative improvements to health care delivery, ranging from clinical pilots to accountable care organizations (ACOs). Boeing is one of a few national employers that now negotiate directly with hospitals and medical groups to provide employee health benefits or specific services. Along with serving on boards and committees of a variety of industry associations, including the St. Louis Business Health Coalition, the National Business Group on Health, and the Employee Benefits Research Institute, Jeff is a member of the LAN Population-Based Payment Work Group.

It’s important for two key reasons. First, the productivity of our workforce is critical in meeting our business goals and keeping our commitments to our customers. We feel that making the health care delivery system more efficient and a better experience for our employees and their dependents will pay dividends for our business in the form of healthier and more productive employees. Second, Boeing invests a significant amount of money in health care benefits for our employees. We need to ensure that we’re getting value for the health care we purchase, investing wisely in our employees and in their future with us.

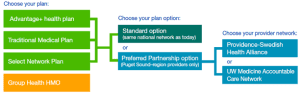

Our priorities align around the Triple Aim: improving the member experience, achieving better- quality outcomes, and lowering costs. As we rolled out this new approach to our membership, an important objective was to maintain employee choice, at the point of service and in health plan selection, and to make the choice as simple as possible. We put together a structure that made the value of participating in the program easy for our employees to understand.

We layered the ACO option, called Preferred Partnership, on top of the current self-funded offerings and made it available to employees to select during annual enrollment. In Puget Sound, WA, for example, employees can keep the same plan they have historically had with the same broad network, or they can select the Preferred Partnership option, which comes with improved benefits and a network specific to our ACO partner. The ACO partner’s network becomes the in-network benefit for any given plan.

Incentives to select the Preferred Partnership option include free primary care office visits, free generic drugs (both subject to the deductible for our High-Deductible Plan), lower paycheck contributions, and higher company contributions to Health Savings Accounts. Also, our ACO partners provide additional resources, such as dedicated call centers and websites that can be used for appointment scheduling, triage, etc. The systems are investing in technologies to improve electronic medical records, coordinate care for our sickest population, and ensure quick access to primary care providers and specialists.

In Puget Sound, our first market, we had 30% enrollment in year 1 and 35% in year 2. For the two markets that followed, St. Louis, MO, and Charleston, SC, enrollment in year 1 was 15%–30%. We will continue to explore other opportunities for expanding our approach in other markets.

We are highly encouraged by the willingness of our health system partners to engage with us and make investments that will support the changes needed to better deliver care. We are using several metrics. Leading indicators suggest strong results from a quality and member experience perspective. Based on focus group results, our employees are happy with the program, giving it an average rating of 8.5 out of 10.

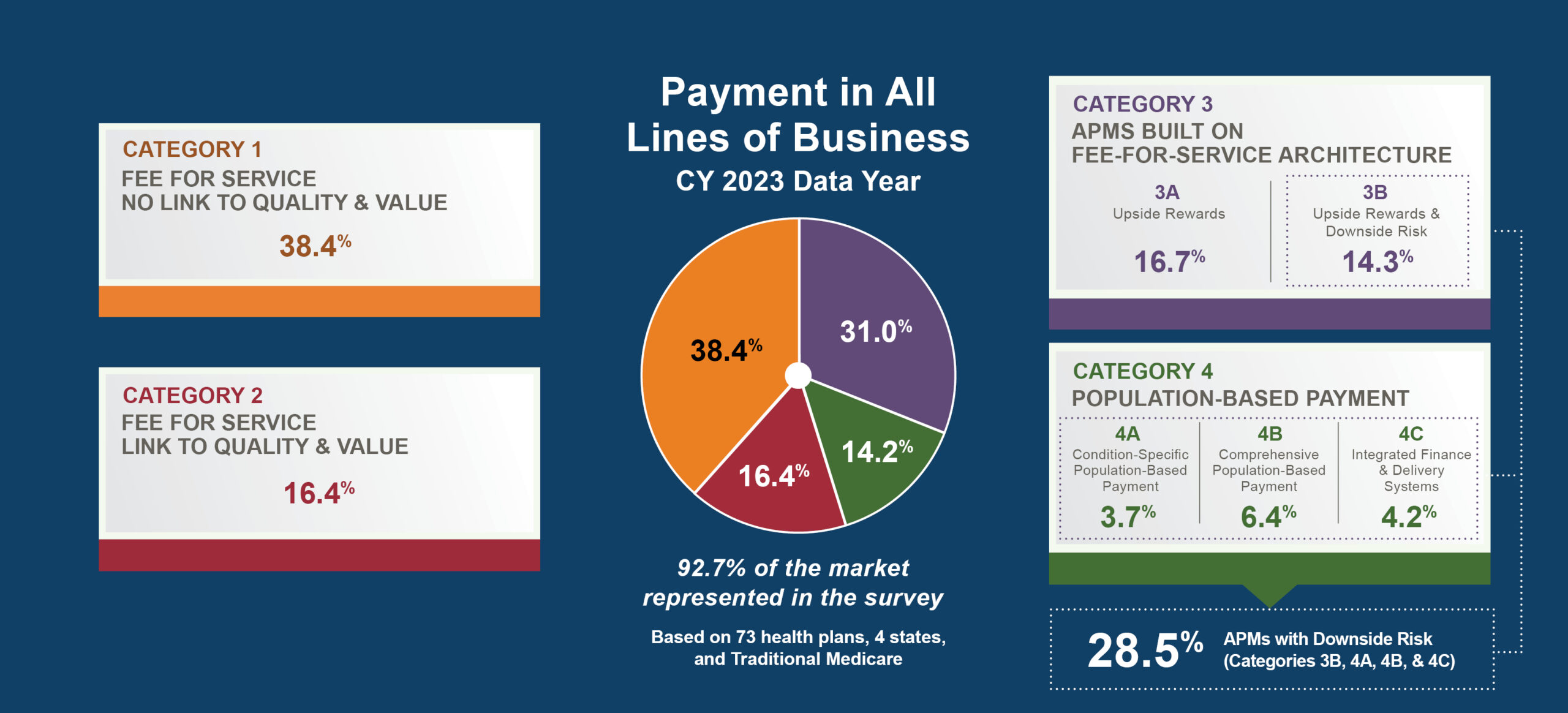

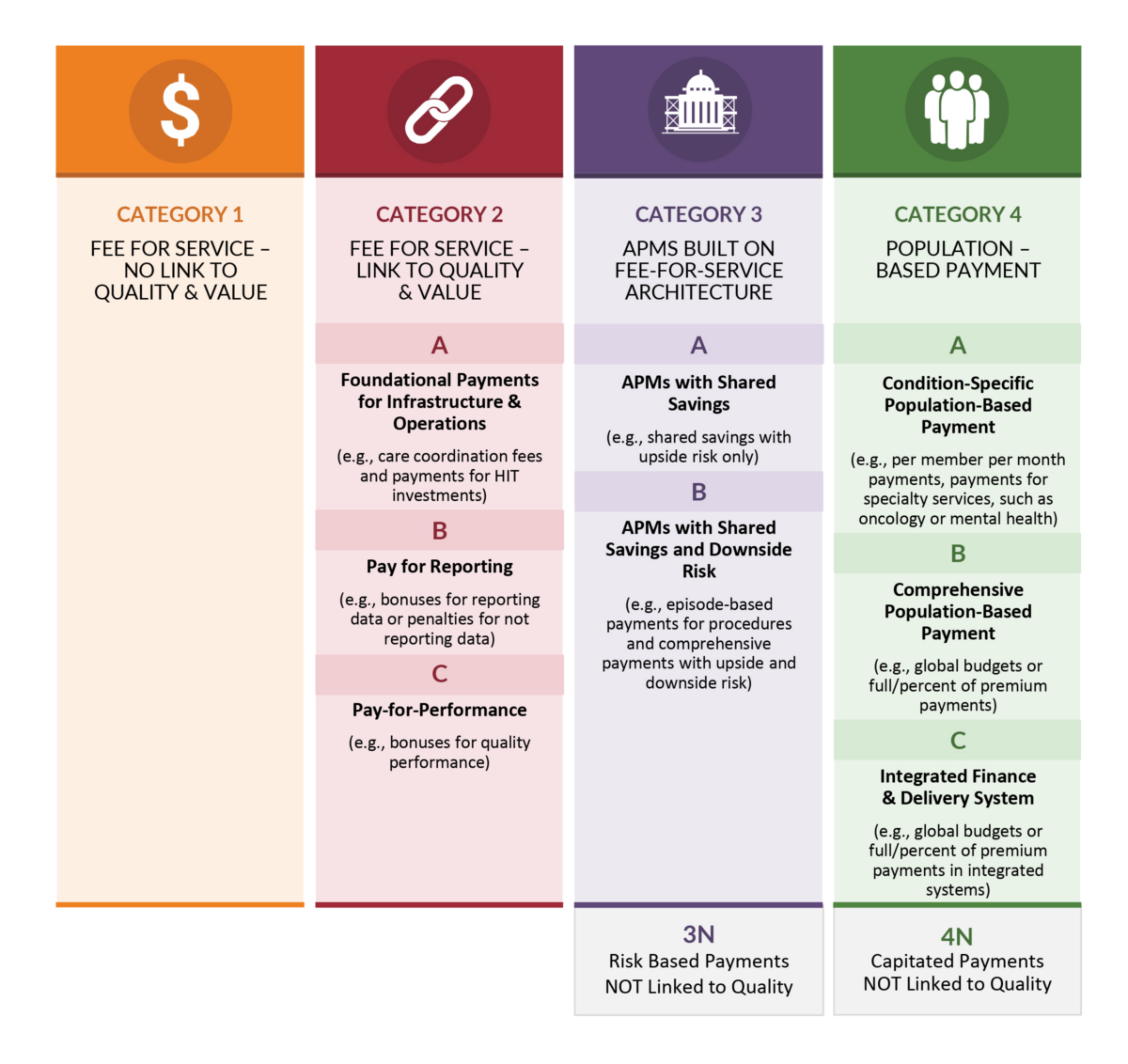

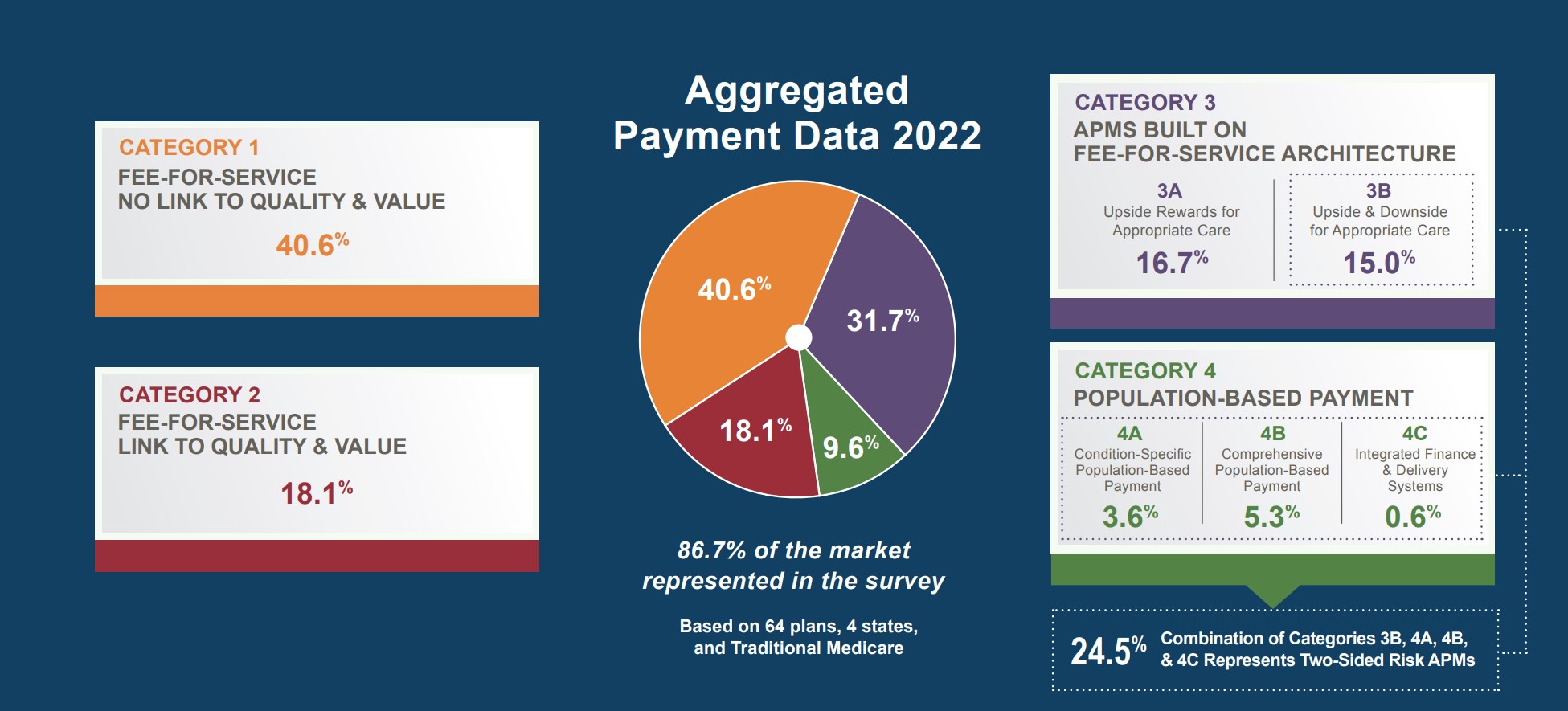

Our ACO option falls within Framework Category 3B, APMs built on fee-for-service architecture, with upside gainsharing and downside risk.

For Boeing, it was a significant effort to develop and negotiate our first ACO contracts. While an upfront investment is needed to get off the ground, we have been able to leverage our learnings and scale our approach to other markets. In an ACO approach such as ours, it is critical that all key stakeholders be tied together and know their roles and responsibilities. For example, many of our third-party administrators had to figure out how to adjust their reporting structures to get new data elements to the ACO more efficiently.

Our view is that the health care issues we face are highly complex and the economic model for purchasing health services is broken. Solving this problem requires the participation of all stakeholders—payers, providers, purchasers, and patients. The public and private sectors alike have a big role, and the LAN is an ideal forum for collaboration.

As an employer, we’ve already benefited from our participation by connecting with various stakeholders to exchange information on value-based purchasing strategies and amplify our voice in national policy discussions. I would encourage other employers to consider the multitude of ways in which they, too, can benefit and get involved in the LAN—join an upcoming purchaser-focused webinar, take a look at the APM documents being produced, attend the spring Summit meeting, for example. The opportunities are many, and there is truly “no wrong door.”

Regardless of your size, it is possible to implement innovative payment models—either directly, as Boeing has, or through your medical carrier, if you’re a fully insured firm. All employers need to take a more active role in shaping the health care payment and delivery system at its core. Employers not only fund a large piece of the system but also are in a position to empower consumers to become better purchasers of health services.

Again, these alternative approaches have multiple entry points. If you’re smaller and just getting started, trade associations, consultants, brokers, and health plans can help get the dialogue going. Industry groups such as the National Business Group on Health (NBGH), Pacific Business Group on Health (PBGH), and Catalyst for Payment Reform (CPR) have excellent resources, some with model contract language and guidance for employers on key considerations for ACOs. For some employers, it might make sense to partner with other like-minded employers and health systems in the community.

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models.

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models. Mr. James Sinkoff is the Deputy Executive Officer and Chief Financial Officer for Sun River Health (formerly known as Hudson River HealthCare), and the Chief Executive Officer of Solutions 4 Community Health (S4CH); an MSO serving FQHCs and private physician practices.

Mr. James Sinkoff is the Deputy Executive Officer and Chief Financial Officer for Sun River Health (formerly known as Hudson River HealthCare), and the Chief Executive Officer of Solutions 4 Community Health (S4CH); an MSO serving FQHCs and private physician practices. Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System.

Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System. Dr. Brandon G. Wilson, DrPH, MHA (he, him, his) joined Community Catalyst as the Director of the Center for Consumer Engagement in Health Innovation, where he leads the Center in bringing the community’s experience to the forefront of health systems transformation and health reform efforts, in order to deliver better care, better value and better health for every community, particularly vulnerable and historically underserved populations. The Center works directly with community advocates around the country to increase the skills and power they have to establish an effective voice at all levels of the health care system. The Center collaborates with innovative health plans, hospitals and providers to incorporate communities and their lived experience into the design of systems of care. The Center also works with state and federal policymakers to spur change that makes the health system more responsive to communities. And it provides consulting services to health plans, provider groups and other health care organizations to help them create meaningful structures for engagement with their communities.

Dr. Brandon G. Wilson, DrPH, MHA (he, him, his) joined Community Catalyst as the Director of the Center for Consumer Engagement in Health Innovation, where he leads the Center in bringing the community’s experience to the forefront of health systems transformation and health reform efforts, in order to deliver better care, better value and better health for every community, particularly vulnerable and historically underserved populations. The Center works directly with community advocates around the country to increase the skills and power they have to establish an effective voice at all levels of the health care system. The Center collaborates with innovative health plans, hospitals and providers to incorporate communities and their lived experience into the design of systems of care. The Center also works with state and federal policymakers to spur change that makes the health system more responsive to communities. And it provides consulting services to health plans, provider groups and other health care organizations to help them create meaningful structures for engagement with their communities. Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.