Why should employers care about health care payment reform? Because of a concern over the continuing rise in health care costs.

It’s really quite simple. Company business models cannot sustain increases in general and administrative expenses (which is where most employers pay for employee benefits) that exceed increases in other income streams. So how can we stop this ever increasing spiral of health care costs that are impacting both companies and their employees?

Realigning the Payment System

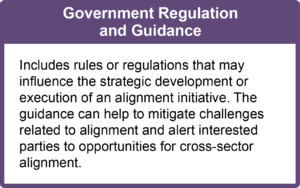

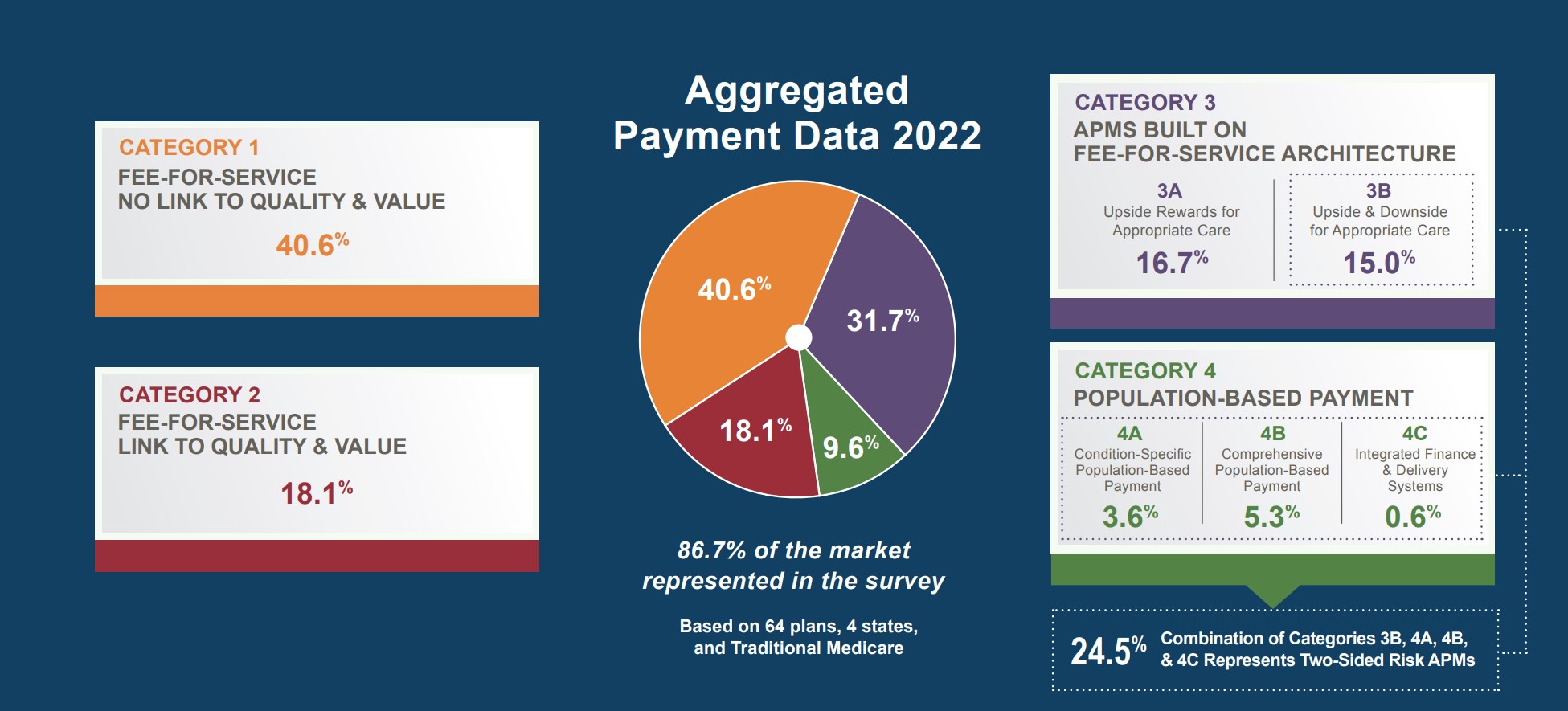

In my opinion, the primary strategy employers must embrace is to work at realigning the payment system. The current fee-for-service payment system primarily incentivizes more care, rather than appropriate care based on quality and safety. Fixing the payment system can actually result in limiting the cost increases AND drive quality improvements. This isn’t a novel idea. Employers have been talking about this for the last 10 years. Why does it seem so hard to fix this? And why aren’t more employers engaged in the solution?

Perhaps it’s because by fixing the payment model, there will be real and perceived winners and losers. So if employers don’t want to be the perceived loser or, worse, the real loser, then we need to make sure we play a part in defining the rules of the new game.

We Can’t Rely on the Carriers to Fix Our Health Care System

Right now, most of us use one or more health care companies (referred to hereafter as “carriers”) either as an insurer or as a third-party administrator (TPA) to manage our health care expenditures. For decades, we have chosen to “outsource” this work to the carriers because health care is not our primary business and we have very small staffs that can barely keep up with the ongoing increases in compliance issues related to administering benefit plans. So we’re waiting on the carriers to address our broken system. Shouldn’t their goals align with ours? We’re the customer, right? Well, actually, carriers have many stakeholders that they must consider:

- Most are publicly traded and must consider their shareholders. The amount of money they make directly correlates to how much health care costs. The more it costs, the more they make from their customers…us.

- Most consider their provider network to be a key competitive advantage. So by default they must consider the provider community a primary stakeholder they can’t ignore.

- Many have a large volume of business with CMS/Medicare and must have systems and processes which support their largest payer.

It’s Up to Employers to Get Engaged to Fix Our Health Care System

Employers are the one payer group that relies on no other capital resource to pay for health care costs besides themselves. Congress has legislative authority to raise Medicare premiums or increase taxes. Insurance companies can simply raise their premiums. What can employers do? We can rearrange the payment system so that everyone cares whether the health care that is provided is appropriate, so that all parties are satisfied that they have had a fair business deal. And employers won’t be satisfied if we aren’t at the table determining what is suitable to us.

Here’s one other thing employers must understand. No one really knows what will or won’t work. And we won’t know until we try some things. We can’t wait until someone else does “it” and has a well-documented business case that can prove “it” works…because it may not. We need to be at the table with our best guess about what might work and then be willing to take a gamble, pilot a few ideas, and share outcomes.

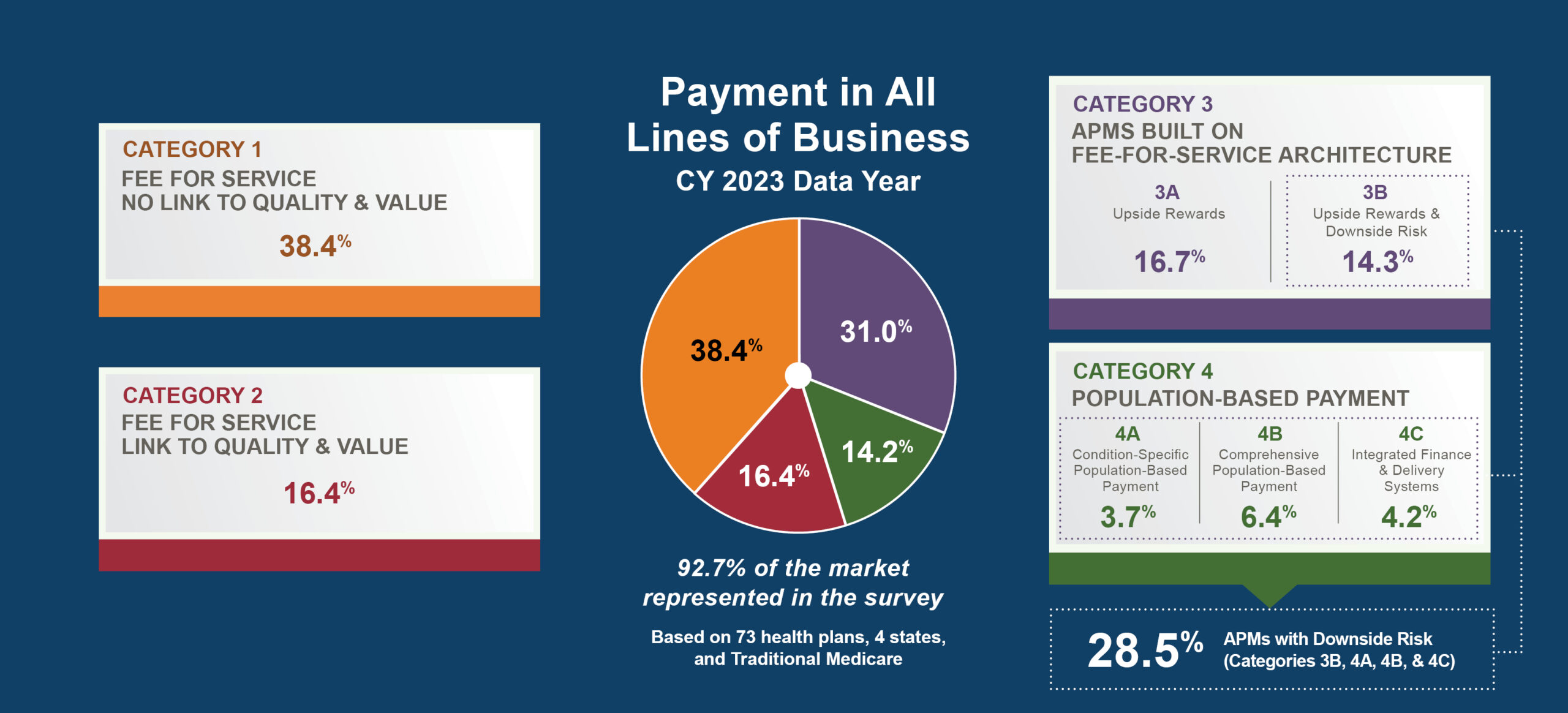

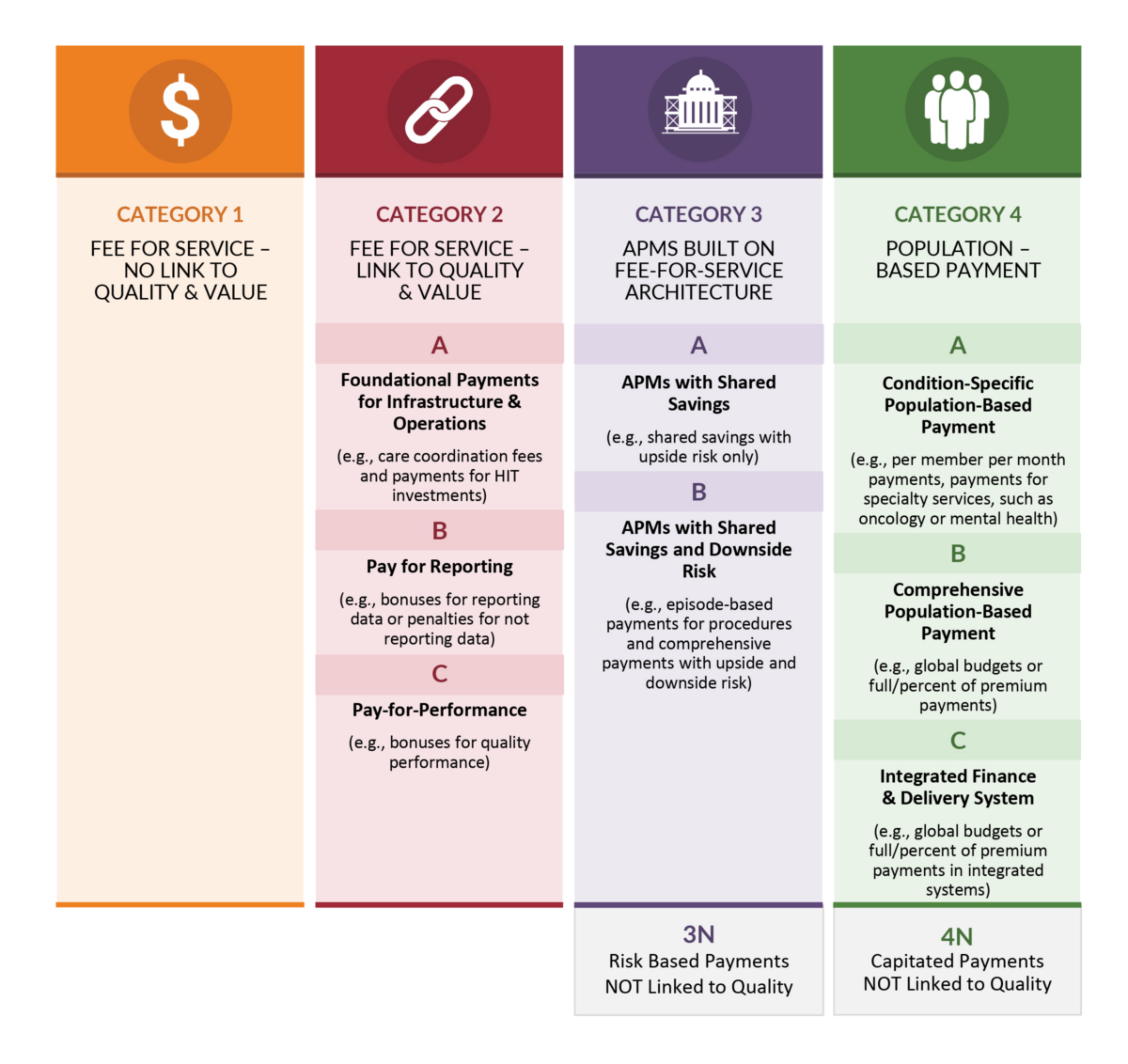

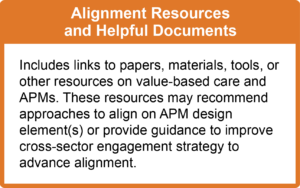

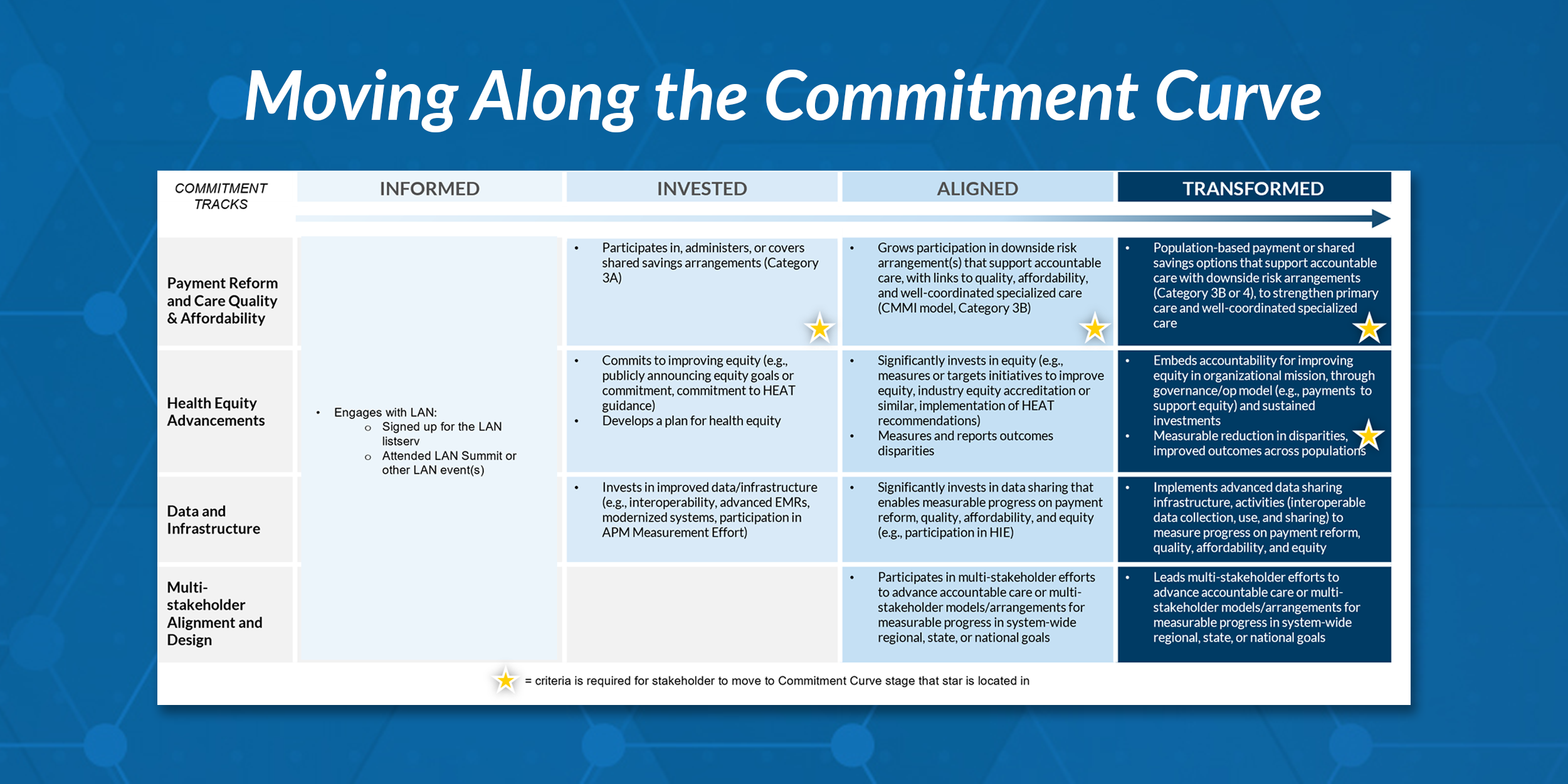

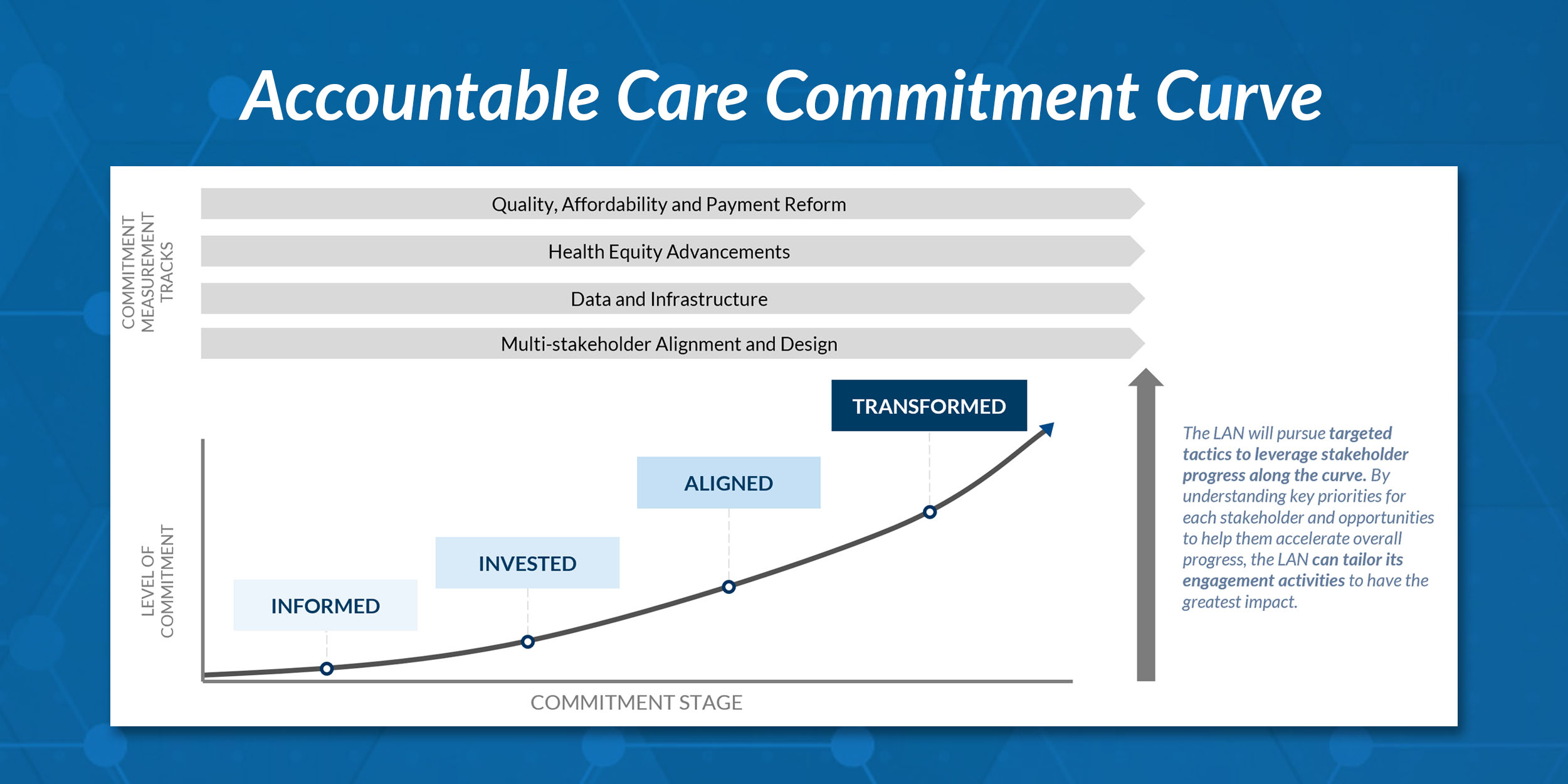

So, here’s a suggestion for employers—get engaged in the dialogue and use your voice to influence how the massive checks your company writes to carriers will hold providers accountable. The Health Care Payment and Learning Action Network (LAN) was initiated by the Department of Health and Human Services to align stakeholders across sectors in moving payment from traditional fee-for-service (FFS) methods to FFS linked to quality and alternative payment models (APMs). “Private payers” does not just mean insurers, it also means employers.

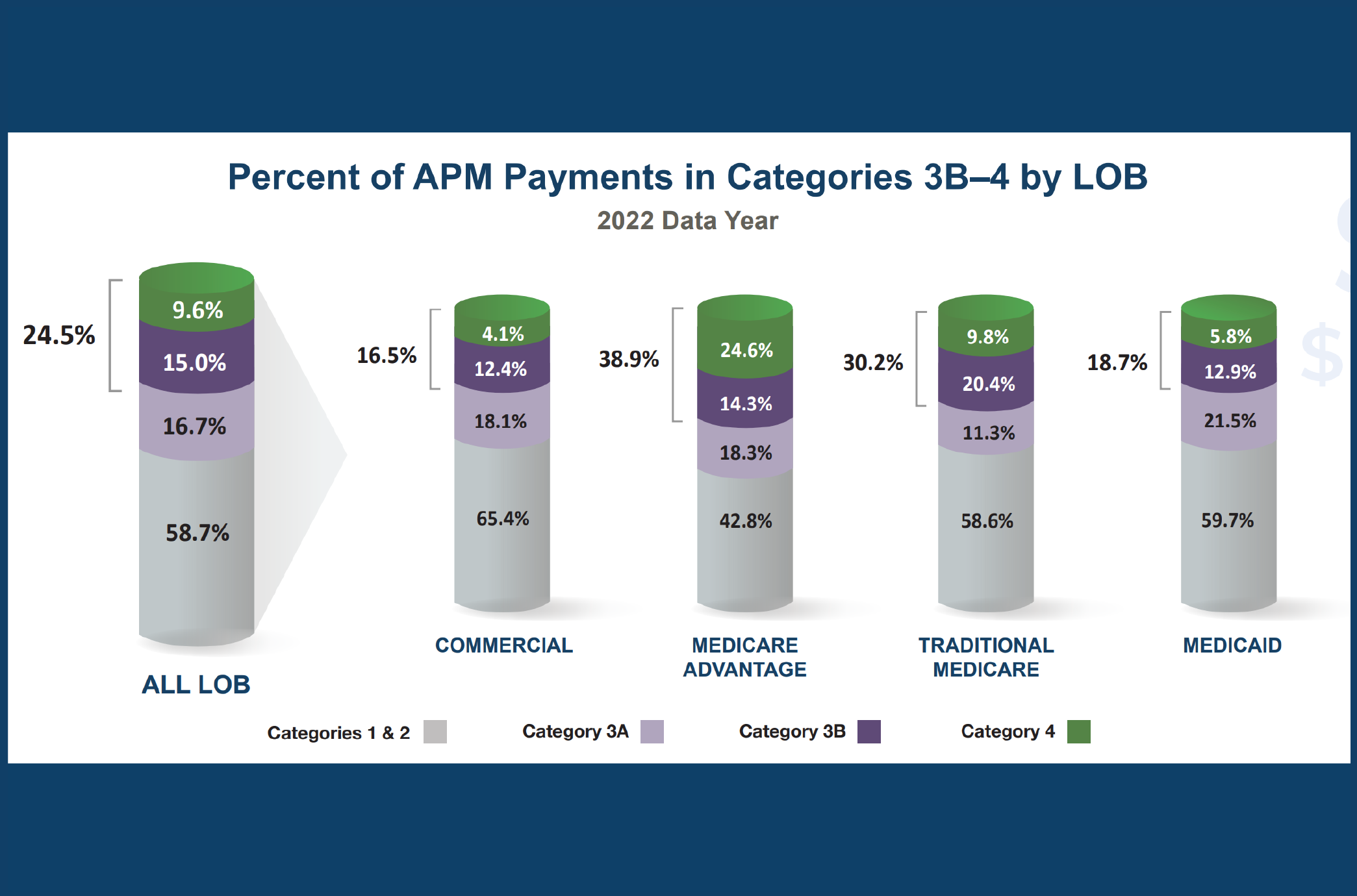

I urge employers to become familiar with the payment categories and to review the many APM examples outlined by the LAN’s APM Framework and Progress Tracking Work Group in its APM Framework White Paper. Other LAN work groups are now developing recommendations for models that many purchasers are directly involved in, including population-based payments, joint replacements, and other APMs. I urge you to join this affiliated community, know what recommendations are being developed, and ensure your voice is heard in the process. More importantly, I urge you to consider what you can do to move your organization to smarter, value-based purchasing of health care. Don’t just sit back and wait for what comes out in the end, because as noted motivational speaker Tony Robbins has said…, “If you do what you’ve always done, you’ll get what you’ve always gotten.”

Please note that guest blogs from Guiding Committee and Work Group members represent the views of the individual authors and do not represent official positions of the Guiding Committee, Work Groups, CAMH, or CMS.

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models.

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models. Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System.

Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System. Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.